Monday, November 30, 2009

Deans can't read, but they can count

In a new NBER working paper (ungated version here) Hammermesh and Pfann show that citations and not number of publications affect economists' reputations, but the number of publications and not citations affect economists' salaries, thus demonstrating the fundamental truth expressed in the title of this post. It is a fun paper, well worth reading, though I am not enamored with their proxies for reputation.

Recognize the Honduran Elections

The Presidential election in Honduras was Sunday. Turnout is reported as fairly high (61%) and Pepe Lobo appears to be the clear winner. Many in the Latin American blogosphere are urging that the US not recognize the elections or normalize their relations with Honduras (here is an example).

I just don't understand that. This was a regularly scheduled election. To the best of my knowledge, neither of the candidates complained that their campaigning was being restricted or that conditions for the vote were unfair. There were tons of rich country observers monitoring the elections. Neither candidate was a "Zelaya guy".

I agree that Zelaya never should have been deported. I am not totally sure whether or not his removal from office (as a separate issue from his deportation) was legitimate. But I don't see how these issues justify not recognizing the results of this election.

Nor am I sure at this point what would satisfy the folks who are advocating non-recognition.

Are they asking for the election results to be tossed and Zelaya returned to office open-ended?

Do they think that if Zelaya is re-instated and new elections were held in a month that the outcome would be different?

This is just speculation on my part, but I think Honduras is paying for the past sins of previous US governments in the region. We did horrendous things in Guatemala and Argentina (to name a couple cases I am familiar with), and now people who disagreed with and protested against or grew up resenting our government because of these heinous acts are having their day even though the current situation is not remotely similar.

One of the funniest (at least to me) reasons for not recognizing the results given in the blog post I linked to above is that we should not do so in the name of supporting regional consensus. Meaning I guess that the Venezuela, Ecuador, Bolivia and Nicaragua bloc should have veto power over US policy in Latin America.

Sunday, November 29, 2009

Saturday, November 28, 2009

Ango-Damus

At breakfast this morning, I was regaling Mrs. Angus with my theory that Tiger Woods' injuries were not from the car wreck, but rather from Mrs. Woods, and that she didn't bust Tiger's whip with his driver to get him out of the car post wreck, but rather was simply wailing away on the car as el Tigre tried to escape her fury.

People, I need to sell stock tips or something!!

How do I do it? Expect the worst from celebrities and you will generally be in the ballpark!

Friday, November 27, 2009

Fantastic Mr. Fox: Mixed Reviews

The LMM and I went to see "The Fantastic Mr. Fox."

Mungowitz: quite good. Lots of laughs. Pretty deep theme. I liked it a lot.

The LMM: "WHAT...the HELL....was that? Why did you TAKE me to see that horrible movie?"

Mungowitz: quite good. Lots of laughs. Pretty deep theme. I liked it a lot.

The LMM: "WHAT...the HELL....was that? Why did you TAKE me to see that horrible movie?"

Tiger Hurt; Windermere in the News!

So, Tiger Woods has been hurt, moderately badly, after hitting a fire hydrant after pulling out of his driveway in ....Windermere, FL!

I did not know that he had a home in Windermere. Or, as John Jarosz always called it, "Windermar, home of the Wombats."

Anyway, I'm sorry that this happened.

But ....Windermere? My home town, basically. (I grew up in nearby Gotha, home of the mighty Gophers).

Some interesting things (interesting to me, anyway).

1. Tiger lives in Isleworth. Now, Isleworth is a very nice place, one of the most exclusive areas in central FLA. But when I was growing up, Isleworth was literally a ghetto, a walled enclosure where the black people, or "pickers" (they picked oranges) lived. It was VERY poor, and the segregated school system was horrible for African-Americans. Amazing that a black man, one of the richest in all of U.S. sports, lives in Isleworth. I cringe when I hear that.

2. He hit a fire hydrant. In fact, the story says, "Woods, had pulled out of his driveway in a Cadillac SUV....As he began to drive .... (Woods) struck a fire hydrant," FHP reported. The front of Wood's vehicle "then struck a tree" located at a neighboring property." Now, in a nice place like Isleworth, they don't put the fire hydrant in the middle of the street. They don't even do that in Gotha, fercrissakes. So, I'm guessing that texting was involved, here.

3. Apparently, they took the injured Tiger to.... Health Central Hospital in Ocoee. Really? My high school chum, and wedding groomsman, Dr. John C. Cappleman, is an internal med specialist, and longtime surgeon, at Health Central. I wonder if he will see Tiger?

Anyway, I do hope that Tiger is okay, and that the facial lacerations are not deep, or in his eyes. But...Isleworth? Really? We used to ride bikes there, but the little black kids would throw rocks at us, and in retrospect I don't blame them.

UPDATE: I have seen, in two places now, that "charges are pending." Texting, for sure. Ugh.

UPDATE II (Friday 10 pm): Yes, "texting" is a eupemism for being drunk. Apparently Tiger's wife used a golf club to break him out of the car. Still, isn't it strange that he pulled out of his driveway, and smashed his car after driving 100 yards? Domestic dispute? No, I don't know why I am so interested that I am just making stuff up.

UPDATE III (Saturday 8 am): The LMM's take: (a) She should have left him in the car. Elin apparently broke in through the back and dragged Tiger out. Neck/spinal injuries, even minor ones, mean that dragging Tiger out all the way from front to back...nuts. (b) Sounds a lot like Elin and Tiger had a fight. She reminds him of something. He gets mad. She gets madder. He says something that crosses a line. She gets REALLY mad. He slams door, gets in car, squeals out of driveway to show how mad he is, and loses control and smashes into fire hydrant/tree. This does sound plausible, since otherwise it is hard to see how he could be going fast enough to hurt himself. On the other hand, it appears that he wasn' going very fast, because the airbag did NOT deply. Then why did he get hurt? Did she hit him with the golf club?

Interesting. I had not thought of that.

UPDATE IV (Saturday 6 pm): The LMM, and Angus, both guessed this. I did NOT expect this. Wow.

I did not know that he had a home in Windermere. Or, as John Jarosz always called it, "Windermar, home of the Wombats."

Anyway, I'm sorry that this happened.

But ....Windermere? My home town, basically. (I grew up in nearby Gotha, home of the mighty Gophers).

Some interesting things (interesting to me, anyway).

1. Tiger lives in Isleworth. Now, Isleworth is a very nice place, one of the most exclusive areas in central FLA. But when I was growing up, Isleworth was literally a ghetto, a walled enclosure where the black people, or "pickers" (they picked oranges) lived. It was VERY poor, and the segregated school system was horrible for African-Americans. Amazing that a black man, one of the richest in all of U.S. sports, lives in Isleworth. I cringe when I hear that.

2. He hit a fire hydrant. In fact, the story says, "Woods, had pulled out of his driveway in a Cadillac SUV....As he began to drive .... (Woods) struck a fire hydrant," FHP reported. The front of Wood's vehicle "then struck a tree" located at a neighboring property." Now, in a nice place like Isleworth, they don't put the fire hydrant in the middle of the street. They don't even do that in Gotha, fercrissakes. So, I'm guessing that texting was involved, here.

3. Apparently, they took the injured Tiger to.... Health Central Hospital in Ocoee. Really? My high school chum, and wedding groomsman, Dr. John C. Cappleman, is an internal med specialist, and longtime surgeon, at Health Central. I wonder if he will see Tiger?

Anyway, I do hope that Tiger is okay, and that the facial lacerations are not deep, or in his eyes. But...Isleworth? Really? We used to ride bikes there, but the little black kids would throw rocks at us, and in retrospect I don't blame them.

UPDATE: I have seen, in two places now, that "charges are pending." Texting, for sure. Ugh.

UPDATE II (Friday 10 pm): Yes, "texting" is a eupemism for being drunk. Apparently Tiger's wife used a golf club to break him out of the car. Still, isn't it strange that he pulled out of his driveway, and smashed his car after driving 100 yards? Domestic dispute? No, I don't know why I am so interested that I am just making stuff up.

UPDATE III (Saturday 8 am): The LMM's take: (a) She should have left him in the car. Elin apparently broke in through the back and dragged Tiger out. Neck/spinal injuries, even minor ones, mean that dragging Tiger out all the way from front to back...nuts. (b) Sounds a lot like Elin and Tiger had a fight. She reminds him of something. He gets mad. She gets madder. He says something that crosses a line. She gets REALLY mad. He slams door, gets in car, squeals out of driveway to show how mad he is, and loses control and smashes into fire hydrant/tree. This does sound plausible, since otherwise it is hard to see how he could be going fast enough to hurt himself. On the other hand, it appears that he wasn' going very fast, because the airbag did NOT deply. Then why did he get hurt? Did she hit him with the golf club?

Interesting. I had not thought of that.

UPDATE IV (Saturday 6 pm): The LMM, and Angus, both guessed this. I did NOT expect this. Wow.

The next best thing

I loved Fire Joe Morgan and was sad when the guys got real jobs (they are the crew behind "Parks & Recreation") and shut 'er down.

Got a new TV. Took it out of the box. The Black Eyed Peas were on the TV, singing a song called "New TV." The TV was not plugged in.

But, I just found out this week that Ken Tremendous is tweeting!

Awesome. You need to follow this guy.

Here is a sample:

Got a new TV. Took it out of the box. The Black Eyed Peas were on the TV, singing a song called "New TV." The TV was not plugged in.

Thursday, November 26, 2009

Turkey-Schmurky

Thanksgiving: Table of Many Mushes

Happy T-giving from KPC East!

Our Thanksgiving table groans under many dishes. For some reason, I have gotten into the habit of making many, many different kinds of mush for Thanksgiving.

This year:

Squash mush. Turnips and carrots mush. Mashed sweet potato mush. Mashed russet potato mush. Mushed fresh cranberries, with mushed apricots. Mushed bread crumbs with mushed sausage and celery.

Plus turkey, gravy, brocolli and peas (unmushed).

Three things were pretty good, I thought.

Brined turkey: 1 cup salt, 1/2 cup brown sugar, rosemary, garlic, celery salt, sage in about 3 gallons of VERY cold water. Let turkey soak for a day, or two. Then cook with turkey body cavities stuffed with apples, onions, and spices.

Fresh cranberry sauce: In a food processor, chop fresh washed cranberries and dried apricots until still just a little lumpy (should be some crunch left in cranberries, not a paste). Add 2 cups water. Cook on low heat, just until it boils. Add on Jello package, lemon flavor. Let sit in fridge for two days.

Dressing: Use any kind of bread crumbs. If seasoned, leave out seasoning. If not, add sage, salt, and thyme. Maybe some chopped parsley. Put just enough water to moisten. In skillet brown sweet italian sausage (ground, not links), then add onions and celery. When it's done (onions are still a fraction crisp) add a bag of dried cran-raisins. Combine all ingredients and stir. Add more water if you need to.

Let sit in fridge overnight, to let everything get to know each other.

Our Thanksgiving table groans under many dishes. For some reason, I have gotten into the habit of making many, many different kinds of mush for Thanksgiving.

This year:

Squash mush. Turnips and carrots mush. Mashed sweet potato mush. Mashed russet potato mush. Mushed fresh cranberries, with mushed apricots. Mushed bread crumbs with mushed sausage and celery.

Plus turkey, gravy, brocolli and peas (unmushed).

Three things were pretty good, I thought.

Brined turkey: 1 cup salt, 1/2 cup brown sugar, rosemary, garlic, celery salt, sage in about 3 gallons of VERY cold water. Let turkey soak for a day, or two. Then cook with turkey body cavities stuffed with apples, onions, and spices.

Fresh cranberry sauce: In a food processor, chop fresh washed cranberries and dried apricots until still just a little lumpy (should be some crunch left in cranberries, not a paste). Add 2 cups water. Cook on low heat, just until it boils. Add on Jello package, lemon flavor. Let sit in fridge for two days.

Dressing: Use any kind of bread crumbs. If seasoned, leave out seasoning. If not, add sage, salt, and thyme. Maybe some chopped parsley. Put just enough water to moisten. In skillet brown sweet italian sausage (ground, not links), then add onions and celery. When it's done (onions are still a fraction crisp) add a bag of dried cran-raisins. Combine all ingredients and stir. Add more water if you need to.

Let sit in fridge overnight, to let everything get to know each other.

Things I am thankful for

1. Mrs. Angus and Mr. Tooty.

2. Not having to have a traditional Thanksgiving dinner (we are having homemade gnocchi!).

3. That the people of Seattle dissed the Sonics and the people of Oklahoma City voted to tax themselves (considerably) to attract them.

4. The amazing trips to Brazil and Churchill we took this year.

5. The success of the development and growth reading group that Mrs. A and I set up this year in our department.

6. Even after 25 years of doing it, I still love my job (and I still have it!).

7. KPC is alive and well and growing.

Wednesday, November 25, 2009

The multiplier under extreme circumstances

One objection often made to studies showing that the fiscal multiplier may be quite small is that the studies do not explicitly take into account the direness of the current economic situation. Now a new NBER working paper (early ungated version here) by Almunia, Bénétrix, Eichengreen, O'Rourke, and Rua attempts to do exactly that.

It is titled From Great Depression to Great Credit Crisis: Similarities, Differences and Lessons.

Here is the abstract:

The Great Depression of the 1930s and the Great Credit Crisis of the 2000s had similar causes but elicited strikingly different policy responses. It may still be too early to assess the effectiveness of current policy responses, but it is possible to analyze monetary and fiscal policies in the 1930s as a “natural experiment” or “counterfactual” capable of shedding light on the impact of recent policies. We employ vector autoregressions, instrumental variables, and qualitative evidence for a panel of 27 countries in the period 1925-1939. The results suggest that monetary and fiscal stimulus was effective – that where it did not make a difference it was not tried. The results also shed light on the debate over fiscal multipliers in episodes of financial crisis. They are consistent with multipliers at the higher end of those estimated in the recent literature, consistent with the idea that the impact of fiscal stimulus will be greater when banking systems are dysfunctional and monetary policy is constrained by the zero bound.

This is potentially an important and fascinating finding. I am going to read this piece carefully over the holiday.

It is titled From Great Depression to Great Credit Crisis: Similarities, Differences and Lessons.

Here is the abstract:

The Great Depression of the 1930s and the Great Credit Crisis of the 2000s had similar causes but elicited strikingly different policy responses. It may still be too early to assess the effectiveness of current policy responses, but it is possible to analyze monetary and fiscal policies in the 1930s as a “natural experiment” or “counterfactual” capable of shedding light on the impact of recent policies. We employ vector autoregressions, instrumental variables, and qualitative evidence for a panel of 27 countries in the period 1925-1939. The results suggest that monetary and fiscal stimulus was effective – that where it did not make a difference it was not tried. The results also shed light on the debate over fiscal multipliers in episodes of financial crisis. They are consistent with multipliers at the higher end of those estimated in the recent literature, consistent with the idea that the impact of fiscal stimulus will be greater when banking systems are dysfunctional and monetary policy is constrained by the zero bound.

This is potentially an important and fascinating finding. I am going to read this piece carefully over the holiday.

Helpful advice from your friends at KPC

(1) Guys, when you leave your young son in your truck to go drinking at a strip club, it's not a good idea to forget where you parked when you leave the club at 1:00 in the morning! And if you do, calling the cops to report it stolen is not the recommended move.

INDIANAPOLIS – A man was arrested after police said he left his 5-year-old son in a tractor-trailer while he ducked into an Indianapolis strip club to drink. The 39-year-old was arrested at 1:15 a.m. Tuesday on child neglect and public intoxication charges after calling police to report his truck stolen and his child missing. Police said the man was too drunk to remember where he had parked.

They found the boy inside watching cartoons on a television inside the cab. The keys were in the ignition, and the doors were unlocked.

Police said the suspect put his son in jeopardy by leaving him exposed in a high crime area.

The man was taken to the Marion County jail, where his wife picked up him and the child.

Oh, that reminds me:

(2) Ladies, when your husband leaves your kid stashed in his truck while he hits the strip club and then calls you in the middle of the night to come get them at the police station, it is A-OK to only pick up the kid and leave the husband in the hoosegow!

At least if you are in Indianapolis:

INDIANAPOLIS – A man was arrested after police said he left his 5-year-old son in a tractor-trailer while he ducked into an Indianapolis strip club to drink. The 39-year-old was arrested at 1:15 a.m. Tuesday on child neglect and public intoxication charges after calling police to report his truck stolen and his child missing. Police said the man was too drunk to remember where he had parked.

They found the boy inside watching cartoons on a television inside the cab. The keys were in the ignition, and the doors were unlocked.

Police said the suspect put his son in jeopardy by leaving him exposed in a high crime area.

The man was taken to the Marion County jail, where his wife picked up him and the child.

Oh, that reminds me:

(2) Ladies, when your husband leaves your kid stashed in his truck while he hits the strip club and then calls you in the middle of the night to come get them at the police station, it is A-OK to only pick up the kid and leave the husband in the hoosegow!

Tuesday, November 24, 2009

All Hail A-Poo!

Albert Pujols is the unanimous pick for NL MVP. It is his second consecutive such award and his third total.

Kudos to you, sir!

The Most Insightful Post....

This is just the most insightful post, on lateness. Very sweet, and self-reflective.

One of the reasons I am pretty hard on late people now is that I was a notorious late-ster. (And I still sometimes miss meetings completely, because I forget them....)

My objection is the people who are ALWAYS late, but make excuses. (And I object because that used to be me). There is one guy in my department (his initials are Herbert Kitschelt) who is ALWAYS ten minutes late for faculty meetings. But Herbert never apologizes. He hates the chit-chat, late starting, time-wasting patter of the first ten minutes of faculty meetings. He is just straight up intentionally late.

No objections, no complaints from me. If you are late on purpose, and admit it, I actually find that perfectly admirable. But don't give me lame excuses.

Further, I should point out that Herbert is always precisely on time, and is in fact two minutes EARLY for small meetings where being late would actually hold other people up. It's just the big meetings, the stupid meetings, that he is late for.

It's the Platonic Travellers that bother me....

One of the reasons I am pretty hard on late people now is that I was a notorious late-ster. (And I still sometimes miss meetings completely, because I forget them....)

My objection is the people who are ALWAYS late, but make excuses. (And I object because that used to be me). There is one guy in my department (his initials are Herbert Kitschelt) who is ALWAYS ten minutes late for faculty meetings. But Herbert never apologizes. He hates the chit-chat, late starting, time-wasting patter of the first ten minutes of faculty meetings. He is just straight up intentionally late.

No objections, no complaints from me. If you are late on purpose, and admit it, I actually find that perfectly admirable. But don't give me lame excuses.

Further, I should point out that Herbert is always precisely on time, and is in fact two minutes EARLY for small meetings where being late would actually hold other people up. It's just the big meetings, the stupid meetings, that he is late for.

It's the Platonic Travellers that bother me....

Larry got game!

As Noam Scheiber reveals in TNR:

A quick look at Summers suggests diving for drop shots isn’t really his game, though opponents say he’s deceptively agile. The typical Summers point will start with a cannon-like serve. If the return is weak, the bulky six-footer will cut the ball off and swing for a difficult angle. Each additional shot is more likely than the last to either be out or un-returnable--the shorter the rally the better. As a player, "Larry is very tenacious … like his personality," says Summers’s sometime coach, Nick Bollettieri. "I don’t think Larry ever smiles." (Adds Bollettieri: "I told Larry if he has enough money, I can still get him to another level.")

Yes that's THE NicK Bollettieri, erstwhile coach of Andre Agassi and tons of other pros. What's he doing in the story? Well:

Not long after leaving office in 2001, Summers and a Treasury colleague named Lee Sachs spent a long weekend refining their strokes at Bollettieri’s world-famous tennis academy in Florida. "He and I were making the adjustments to post-government life," Summers recalls. "His father lived down there, and we decided to try it for several days."

The trip soon became an annual ritual, with Geithner, Sperling, and several other former colleagues joining in. Each March, the wonks-in-exile would present themselves to the Bollettieri instructors for two days of extensive drilling.

Yikes!

A quick look at Summers suggests diving for drop shots isn’t really his game, though opponents say he’s deceptively agile. The typical Summers point will start with a cannon-like serve. If the return is weak, the bulky six-footer will cut the ball off and swing for a difficult angle. Each additional shot is more likely than the last to either be out or un-returnable--the shorter the rally the better. As a player, "Larry is very tenacious … like his personality," says Summers’s sometime coach, Nick Bollettieri. "I don’t think Larry ever smiles." (Adds Bollettieri: "I told Larry if he has enough money, I can still get him to another level.")

Yes that's THE NicK Bollettieri, erstwhile coach of Andre Agassi and tons of other pros. What's he doing in the story? Well:

Not long after leaving office in 2001, Summers and a Treasury colleague named Lee Sachs spent a long weekend refining their strokes at Bollettieri’s world-famous tennis academy in Florida. "He and I were making the adjustments to post-government life," Summers recalls. "His father lived down there, and we decided to try it for several days."

The trip soon became an annual ritual, with Geithner, Sperling, and several other former colleagues joining in. Each March, the wonks-in-exile would present themselves to the Bollettieri instructors for two days of extensive drilling.

Yikes!

Misunderstood?

Ah Hugo Chavez, the gift that just keeps giving. Now he's in the news for his sympathetic take on Carlos the Jackal, Robert Mugabe, and Idi Amin:

"They accuse him of being a terrorist, but Carlos really was a revolutionary fighter," Chávez said during a televised speech on Friday.

Chávez defended other leaders he said were wrongly branded "bad guys", including Mugabe and Ahmadinejad, a close ally who is due to visit Caracas this week during a South America tour.

He also said that Amin, whose regime is accused of killing 300,000 Ugandans in the 70s, may not have been so bad. "We thought he was a cannibal. I have doubts. I don't know, maybe he was a great nationalist, a patriot."

"They accuse him of being a terrorist, but Carlos really was a revolutionary fighter," Chávez said during a televised speech on Friday.

Chávez defended other leaders he said were wrongly branded "bad guys", including Mugabe and Ahmadinejad, a close ally who is due to visit Caracas this week during a South America tour.

He also said that Amin, whose regime is accused of killing 300,000 Ugandans in the 70s, may not have been so bad. "We thought he was a cannibal. I have doubts. I don't know, maybe he was a great nationalist, a patriot."

Yikes!!!

Monday, November 23, 2009

Immigration: Good!

I showed this article to one of the people who constantly berates me for my support of (nearly) open borders.

Her response, verbatim: "What would you expect some damned foreigner to say? 'Giovanni'? What kind of American name is that?"

Nice.

(Nod to Angry Alex)

Her response, verbatim: "What would you expect some damned foreigner to say? 'Giovanni'? What kind of American name is that?"

Nice.

(Nod to Angry Alex)

She blinded me with science

Thanks as always to Tyler for bringing this "scandal" to my attention. I am using quotes here because, in my opinion, this is just business as usual in academics. There may not be such a blatant electronic "paper trail" on display, but protecting turf, punishing heretics, and rewarding your friends is the coin of the realm.

Take macroeconomics for example. Who is the premier employer of monetary economists? Yes, it is the Federal Reserve System. Who as a class of researchers really deeply loves them some Fed? Yes, it is monetary economists. Fed independence is taken as a given an as a desideratum. Heretics (sour grapes warning: I am a Fed heretic) find it extremely difficult to publish dissenting views.

I have a piece in the JME on political influence on the Fed. Pretty good publication for me, but the paper took 7 years to find a home and the results in it were unchanged from the first version (which was from my dissertation).

I would go so far as to say that every scientific "consensus" based on empirical evidence is far weaker that it is made to appear via mechanisms like those described in the Climategate story.

Sunday, November 22, 2009

Cute! What is it for?

Shirley, loyal reader, sent an email to my wife, the LMM.

The LMM had sent a bunch of pix from Europe and elsewhere, so Shirley could look at them all. And the LMM had put the pix on the little thumb drive, with a USB jack.

Shirley's response: "Oh forgot,what is USB Drive. It is really cute but I have no idea what it is for."

Which made me stop and think: it IS, in fact, pretty amazing what those little flash drives can do. Very cool. But you do have to know what a USB drive is. Otherwise, they are just "cute."

The LMM had sent a bunch of pix from Europe and elsewhere, so Shirley could look at them all. And the LMM had put the pix on the little thumb drive, with a USB jack.

Shirley's response: "Oh forgot,what is USB Drive. It is really cute but I have no idea what it is for."

Which made me stop and think: it IS, in fact, pretty amazing what those little flash drives can do. Very cool. But you do have to know what a USB drive is. Otherwise, they are just "cute."

I'm a full grown man but I ain't afraid to cry

Beck Hansen and Jack Black. People you KNOW it has got to be good!

Midnite Vultures "Sexx Laws" from Beck Hansen on Vimeo.

A Rant, and A Movie Review, Sort Of

I went to see Michael Moore's "Capitalism: A Love Affair" a few weeks ago, working for WPTF radio. And, I actually thought it was pretty good. Funny. And the middle part was excellent, really first rate. MMoore smashed four people who needed smashing. Those four? L. Summers, T. Geithner, B. Frank, and C. Dodd. Two economists, a narcissistic goofball, and an unprincipled drunk, in that order.

But then I read something by the good DeLong. And it struck me....well, here's my rant:

Folks, there is a contest out there for who understands economics better. The contestants are Dr. Brad DeLong, econ prof at Univ of Cal-Berkeley, and....the filmmaker, Michael Moore.

Almost unbelievably, and frankly *I* can't believe I'm saying this, the winner is....Michael Moore.

Dr. DeLong is fussing and moaning that a few people have finally come to their senses, and (as he puts it) "dug in their heels" on the enormous deficit. As it stands, folks, combining the state and federal government deficits for the next two years, what we already KNOW about, each working person in the U.S. owes well over $100,000, mostly to the Japanese and Chinese, who have bought our bonds, our debt, our Treasury bills.

(Editor note: "working person" means people with jobs. There are only about 150 million working people in the US. The projected debt of the feds is about $70k / worker, and the states is about $30k / worker)

But Dr. DeLong thinks that is not enough! He is clearly disdainful of those of us who are worried about selling our country, about mortgaging the birthright of our children. He says that if we have one more, just one more, bad economic downturn we may now have a return of the Great Depression. DeLong puts the probability at 5%. What he wants to do is to spend our way out of the recession, but he is not sure we can, because our deficit is so big.

Amazingly, Dr. DeLong cites a discredited theory, a theory no real economists believe anymore. Again, I can scarcely believe this, but DeLong bases his argument on the so-called "Phillips Curve," the theory that unemployment can be driven down by increased inflation.

Folks, this theory has been debunked, and debunked, and discredited, yet policy makers still want to use it. I can cite you a whole fistful of Nobel Prize-winning economists who have proved, absolutely proved, that announcing you are going to use inflation as a policy NEVER reduces unemployment.

So, Dr. DeLong gets an F: back to school, sir!

On the other hand, and I can't believe I'm saying this, either: Michael Moore, in his new movie, gets the cause of the crisis, and the damage of the bailout, about 75% correct. A solid C, for Mr. Moore, a gentleman's C.

Who is to blame? It is clear in the movie, if you watch "Capitalism: A Love Story." The cause of the financial crisis, Mr. Moore is very clear, the men at the center of the financial crisis are....the guys who are now the Obama economic team, and the people in Congress who want to blame everyone but themselves.

Michael Moore lines them all up, and skewers them: Tim Geithner, now head of Treasury. Larry Summers, now Director of Obama's National Economic Council . And, this is the best part, he also goes after people in Congress. Chris Dodd, the Senator from , and Barney Frank, the guy who forced our banks to make all those bad loans to people who couldn't pay them back! Barney Frank, the guy who knocks down old ladies if they get between him and a microphone, and who wants to blame Wall Street....Michael Moore shows how Barney Frank helped cause the crisis! It's delicious.

The point is that the only thing we have to fear is, Porkulus itself! DeLong wants us to spend more, to increase the deficit. But we can't do that. Because, as none other than Michael Moore himself showed, all that TARP money, all that Porkulus money, was wasted, thrown away, poured down a rathole.

DeLong is right about one thing: if we have another crisis, we will really be in trouble. Because we won't be able to bail out Wall Street again. But the reason is that we already spent too much on a useless bunch of policies. We spent like drunken sailors on shore leave. I'm sorry, I take that back, it's an insult to drunken sailors.

The bottom line is unbelievable! Michael Moore gets it right, at least for about ten minutes of his otherwise terrible movie. And Dr. Brad DeLong, a Berkeley economist, gets it wrong. The Phillips Curve is dead. Let it rest in piece, Dr. DeLong.

Whew! I feel better now.

But then I read something by the good DeLong. And it struck me....well, here's my rant:

Folks, there is a contest out there for who understands economics better. The contestants are Dr. Brad DeLong, econ prof at Univ of Cal-Berkeley, and....the filmmaker, Michael Moore.

Almost unbelievably, and frankly *I* can't believe I'm saying this, the winner is....Michael Moore.

Dr. DeLong is fussing and moaning that a few people have finally come to their senses, and (as he puts it) "dug in their heels" on the enormous deficit. As it stands, folks, combining the state and federal government deficits for the next two years, what we already KNOW about, each working person in the U.S. owes well over $100,000, mostly to the Japanese and Chinese, who have bought our bonds, our debt, our Treasury bills.

(Editor note: "working person" means people with jobs. There are only about 150 million working people in the US. The projected debt of the feds is about $70k / worker, and the states is about $30k / worker)

But Dr. DeLong thinks that is not enough! He is clearly disdainful of those of us who are worried about selling our country, about mortgaging the birthright of our children. He says that if we have one more, just one more, bad economic downturn we may now have a return of the Great Depression. DeLong puts the probability at 5%. What he wants to do is to spend our way out of the recession, but he is not sure we can, because our deficit is so big.

Amazingly, Dr. DeLong cites a discredited theory, a theory no real economists believe anymore. Again, I can scarcely believe this, but DeLong bases his argument on the so-called "Phillips Curve," the theory that unemployment can be driven down by increased inflation.

Folks, this theory has been debunked, and debunked, and discredited, yet policy makers still want to use it. I can cite you a whole fistful of Nobel Prize-winning economists who have proved, absolutely proved, that announcing you are going to use inflation as a policy NEVER reduces unemployment.

So, Dr. DeLong gets an F: back to school, sir!

On the other hand, and I can't believe I'm saying this, either: Michael Moore, in his new movie, gets the cause of the crisis, and the damage of the bailout, about 75% correct. A solid C, for Mr. Moore, a gentleman's C.

Who is to blame? It is clear in the movie, if you watch "Capitalism: A Love Story." The cause of the financial crisis, Mr. Moore is very clear, the men at the center of the financial crisis are....the guys who are now the Obama economic team, and the people in Congress who want to blame everyone but themselves.

Michael Moore lines them all up, and skewers them: Tim Geithner, now head of Treasury. Larry Summers, now Director of Obama's National Economic Council . And, this is the best part, he also goes after people in Congress. Chris Dodd, the Senator from , and Barney Frank, the guy who forced our banks to make all those bad loans to people who couldn't pay them back! Barney Frank, the guy who knocks down old ladies if they get between him and a microphone, and who wants to blame Wall Street....Michael Moore shows how Barney Frank helped cause the crisis! It's delicious.

The point is that the only thing we have to fear is, Porkulus itself! DeLong wants us to spend more, to increase the deficit. But we can't do that. Because, as none other than Michael Moore himself showed, all that TARP money, all that Porkulus money, was wasted, thrown away, poured down a rathole.

DeLong is right about one thing: if we have another crisis, we will really be in trouble. Because we won't be able to bail out Wall Street again. But the reason is that we already spent too much on a useless bunch of policies. We spent like drunken sailors on shore leave. I'm sorry, I take that back, it's an insult to drunken sailors.

The bottom line is unbelievable! Michael Moore gets it right, at least for about ten minutes of his otherwise terrible movie. And Dr. Brad DeLong, a Berkeley economist, gets it wrong. The Phillips Curve is dead. Let it rest in piece, Dr. DeLong.

Whew! I feel better now.

Help! Tyler made my head explode

When he referred to this post by Krugman as one out of "two of the best recent economics blog posts, in some time." In fairness, Tyler did do some basic CYA by noting in parentheses that he wasn't sure if he agreed with the post.

So lets break it down, KPC style:

So lets break it down, KPC style:

"From various bat squeaks I’ve put together a view of what I think lies behind the surprising — and damaging — deficit squeamishness of the Obama administration."

Ok, so we start off with a double WTF. Bat squeaks? Is he making fun of Larry Summer's speaking voice?

And what is this about the "deficit squeamishness" of Team Obama?

People, the fiscal 2009 deficit was $1.4 trillion! And thats not just a one time, caused by the recession, deal. According to the CBO, the deficit in 2019 will also be over $1 trillion. Plus Team Obama seems willing to sign on to a health care reform bill that will in all probability further raise the deficit beyond current projections.

I am sorry Paul, but I just don't see any reluctance of the Obama administration to run big deficits.

Krugman then claims, without any supporting evidence, that the main reason why we are running such tiny, puny, pusillanimous deficits is that the government believes that further borrowing could cause long term interest rates to skyrocket because it would unwind a sort of carry trade going on where people are borrowing at ultra low short term rates and lending out at higher long term rates. As he puts it:

"Well, what I hear is that officials don’t trust the demand for long-term government debt, because they see it as driven by a “carry trade”: financial players borrowing cheap money short-term, and using it to buy long-term bonds. They fear that the whole thing could evaporate if long-term rates start to rise, imposing capital losses on the people doing the carry trade; this could, they believe, drive rates way up, even though this possibility doesn’t seem to be priced in by the market."

PK thinks this is a dumb argument. So do I. However, I don't happen to think it is why our deficits are what they are (which to PK is small, but on planet earth where I live, it is fairly large).

People, if Team Obama really wants to run a bigger deficit in theory (which we have no real evidence that they do), but are not doing so in practice, the reason why is much more likely to be that they fear the political fallout from all of us irrational people who would object to such a policy.

Ok, so we start off with a double WTF. Bat squeaks? Is he making fun of Larry Summer's speaking voice?

And what is this about the "deficit squeamishness" of Team Obama?

People, the fiscal 2009 deficit was $1.4 trillion! And thats not just a one time, caused by the recession, deal. According to the CBO, the deficit in 2019 will also be over $1 trillion. Plus Team Obama seems willing to sign on to a health care reform bill that will in all probability further raise the deficit beyond current projections.

I am sorry Paul, but I just don't see any reluctance of the Obama administration to run big deficits.

Krugman then claims, without any supporting evidence, that the main reason why we are running such tiny, puny, pusillanimous deficits is that the government believes that further borrowing could cause long term interest rates to skyrocket because it would unwind a sort of carry trade going on where people are borrowing at ultra low short term rates and lending out at higher long term rates. As he puts it:

"Well, what I hear is that officials don’t trust the demand for long-term government debt, because they see it as driven by a “carry trade”: financial players borrowing cheap money short-term, and using it to buy long-term bonds. They fear that the whole thing could evaporate if long-term rates start to rise, imposing capital losses on the people doing the carry trade; this could, they believe, drive rates way up, even though this possibility doesn’t seem to be priced in by the market."

PK thinks this is a dumb argument. So do I. However, I don't happen to think it is why our deficits are what they are (which to PK is small, but on planet earth where I live, it is fairly large).

People, if Team Obama really wants to run a bigger deficit in theory (which we have no real evidence that they do), but are not doing so in practice, the reason why is much more likely to be that they fear the political fallout from all of us irrational people who would object to such a policy.

I actually agree with Krugman that the government could borrow a lot more money without any directly adverse macro consequences in the short to medium term.

I just didn't see anything in the way the original stimulus bill was constructed and implemented that would make me believe that another round of stimulus from the same set of players would do much for job creation or help put our economy on a sustainable recovery path.

Saturday, November 21, 2009

Pot? Meet Kettle!

So in the process of inviting Dutch EU parliment member Hans Van Baalen to leave the worker's paradise of Nicaragua, the deputy foreign minister, one Manuel Coronel Kautz, called Holland a "Paisucho", which is being translated as "shitty little country" or "crummy little country".

The Nicaraguan government has apologized.

Apparently Manuel Coronel Kautz is known throughout Central America for his colorful and folkloric utterances.

People, if Holland is a shitty little country, what in the world does that make Nicaragua?

Anyone? Bueller?

Friday, November 20, 2009

An inconvenient truth, but for how much longer?

In a comment on my earlier post about Hugo Chavez's adventures in authoritarianism, Globetrotter asked, "I wonder what they will do next?"

Well we didn't have to wait very long to find out:

President Hugo Chávez wasn't pleased with data released this week that showed the Venezuelan economy tumbling into a recession. So the populist leader came up with a solution: Forget traditional measures of economic growth, and find a new, "Socialist-friendly" gauge.

"We simply can't permit that they continue calculating GDP with the old capitalist method," President Chávez said in a televised speech before members of his Socialist party on Wednesday night. "It's harmful."

Mr. Chávez's comments came shortly after data showed Venezuela's gross domestic product -- a broad measure of annual economic output -- fell 4.5% in the third quarter from the year-earlier period. It was the second consecutive quarterly decline, and observers have questioned how Mr. Chávez will be able to generate growth without high oil prices.

Indeed it is harmful, Hugo. Harmful to your bid to be President for life.

Well we didn't have to wait very long to find out:

President Hugo Chávez wasn't pleased with data released this week that showed the Venezuelan economy tumbling into a recession. So the populist leader came up with a solution: Forget traditional measures of economic growth, and find a new, "Socialist-friendly" gauge.

"We simply can't permit that they continue calculating GDP with the old capitalist method," President Chávez said in a televised speech before members of his Socialist party on Wednesday night. "It's harmful."

Mr. Chávez's comments came shortly after data showed Venezuela's gross domestic product -- a broad measure of annual economic output -- fell 4.5% in the third quarter from the year-earlier period. It was the second consecutive quarterly decline, and observers have questioned how Mr. Chávez will be able to generate growth without high oil prices.

Indeed it is harmful, Hugo. Harmful to your bid to be President for life.

Comments on "Late" Article

More from the comments section of the "Sorry I'm Late" piece in the Chronicle. A comment, and my response (yes, I am going all Don Boudreaux on you. But at least my "letter" got published, even if only in a comments section):

62. consideritdone - November 19, 2009 at 07:09 pm

I'm fascinated by this thread in part because I am among the chronically late and have tried various techniques to remedy this habit, with uneven success. I recognize that some people choose to find my lateness a personal affront, and perceive that I value my time more than theirs. This is not the case.

I'm not late because I hate waiting. That has nothing to do with it. I am late because I overcommit, because I underestimate how long tasks will take, because I am a workaholic, and especially because few meetings that I attend actually begin at the appointed hour. Given the choice of arriving early or "on time" and doing some pre-meeting socializing (which can be valuable and fun, too) or finishing the sentence I am writing, I will almost always choose the latter. Then I arrive after the appointed hour. This might be late, or it might be "on time" if on time is defined as the actual moment at which the meeting begins. I never know in advance which outcome will come to pass. (So maybe I am often late because I am a gambler?)

My point is that the variability of actual start times compared to "advertised" start times contributes to lateness. In my town, there is a certain theater that begins movies after the advertised start time when there are still a lot of people in line to get tickets. I imagine they think they are being polite. What they are doing is training their patrons to be late. (And some of us need no assistance with this, as I've confessed.)

I'd suggest that in Mr. Munger's academic culture, the norm is that meetings do not begin at the appointed hour, yet he has not adapted to this reality; he expects punctuality. Meeting organizers have the most control in these situations. If you're in charge and punctuality matters to you (a value not everyone shares), start on time and don't do anything to accommodate latecomers.

63. mcmunger - November 20, 2009 at 08:17 am--Dear Consideritdone:

Wow. A poster child. Everyone who is chronically late makes it seem as the late person is someone better, even noble. YOU, unlike everyone else, are busier, a workaholic.

I hope you don't teach logic, though. First, you claim "I'm not late because I hate waiting. That has nothing to do with it."

And then you IMMEDIATELY say that you are usually late "especially because few meetings that I attend actually begin at the appointed hour." In other words, you hate waiting!

You are not a workaholic; you are simply inefficient and self-absorbed. That's fine; most of us are (I certainly am). One has to be, in fact, to be a successful academic and live mostly inside one's own head. And I'm sure you are in fact a terrific scholar. Perhaps we are making too much of this whole "late" thing; it's not that big a deal.

But I should note the following:

1. Most meetings DO start at the appointed hour, at Duke. But they start without important people (like YOU, consideritdone!) who are socializing, or writing one more sentence.

2. None of your reasons for being late involve unexpected events. You are NOT a Platonic Traveller. You are in fact intentionally and habitually late, as a matter of policy. That makes sense to me, and I applaud you for it. Many meetings are a waste of time, and you can show everyone else how important you are by arriving late.

My complaint, in the little article, is about people who arrive late, ALWAYS arrive late, and then make an excuse. The fact is that they left home, or their office, AFTER THE MEETING WAS SUPPOSED TO START. They are not sorry, in short. They are late on purpose, and won't admit it, even to themselves.

Consideritdone, you are honest and self-aware. I applaud you.

62. consideritdone - November 19, 2009 at 07:09 pm

I'm fascinated by this thread in part because I am among the chronically late and have tried various techniques to remedy this habit, with uneven success. I recognize that some people choose to find my lateness a personal affront, and perceive that I value my time more than theirs. This is not the case.

I'm not late because I hate waiting. That has nothing to do with it. I am late because I overcommit, because I underestimate how long tasks will take, because I am a workaholic, and especially because few meetings that I attend actually begin at the appointed hour. Given the choice of arriving early or "on time" and doing some pre-meeting socializing (which can be valuable and fun, too) or finishing the sentence I am writing, I will almost always choose the latter. Then I arrive after the appointed hour. This might be late, or it might be "on time" if on time is defined as the actual moment at which the meeting begins. I never know in advance which outcome will come to pass. (So maybe I am often late because I am a gambler?)

My point is that the variability of actual start times compared to "advertised" start times contributes to lateness. In my town, there is a certain theater that begins movies after the advertised start time when there are still a lot of people in line to get tickets. I imagine they think they are being polite. What they are doing is training their patrons to be late. (And some of us need no assistance with this, as I've confessed.)

I'd suggest that in Mr. Munger's academic culture, the norm is that meetings do not begin at the appointed hour, yet he has not adapted to this reality; he expects punctuality. Meeting organizers have the most control in these situations. If you're in charge and punctuality matters to you (a value not everyone shares), start on time and don't do anything to accommodate latecomers.

63. mcmunger - November 20, 2009 at 08:17 am--Dear Consideritdone:

Wow. A poster child. Everyone who is chronically late makes it seem as the late person is someone better, even noble. YOU, unlike everyone else, are busier, a workaholic.

I hope you don't teach logic, though. First, you claim "I'm not late because I hate waiting. That has nothing to do with it."

And then you IMMEDIATELY say that you are usually late "especially because few meetings that I attend actually begin at the appointed hour." In other words, you hate waiting!

You are not a workaholic; you are simply inefficient and self-absorbed. That's fine; most of us are (I certainly am). One has to be, in fact, to be a successful academic and live mostly inside one's own head. And I'm sure you are in fact a terrific scholar. Perhaps we are making too much of this whole "late" thing; it's not that big a deal.

But I should note the following:

1. Most meetings DO start at the appointed hour, at Duke. But they start without important people (like YOU, consideritdone!) who are socializing, or writing one more sentence.

2. None of your reasons for being late involve unexpected events. You are NOT a Platonic Traveller. You are in fact intentionally and habitually late, as a matter of policy. That makes sense to me, and I applaud you for it. Many meetings are a waste of time, and you can show everyone else how important you are by arriving late.

My complaint, in the little article, is about people who arrive late, ALWAYS arrive late, and then make an excuse. The fact is that they left home, or their office, AFTER THE MEETING WAS SUPPOSED TO START. They are not sorry, in short. They are late on purpose, and won't admit it, even to themselves.

Consideritdone, you are honest and self-aware. I applaud you.

Thursday, November 19, 2009

Ron Artest explains his shoe toss

A couple days ago, Trevor Arizza lost a shoe on the court, Artest picked it up and chucked it off the court, then went down to the other end of the court and made a 3 pointer while Trevor struggled to re-shoe himself.

That, of course, was awesome.

Even more awesome though is Ron-Ron's explanation of what happened:

“Well what happened was…obviously I didn’t know his shoe would come off that’s the first thing conservative reporters. I didn’t know his shoe was gonna come off. I don’t speak to his feet so I don’t know what his feet are thinking, I don’t know what his toes are thinking, I don’t know what he’s thinking. Then his shoe comes off and I’m like okay a shoe is not supposed to be on the basketball court without somebody standing inside of it. So I said alright, I’m just gonna buy me some time. I really didn’t know whose shoe it was, but I said it has to be one of the player’s shoe. As soon as I toss it off the court, not throw into the stands which some people said, it’ll buy me some time. What happens is I come back down, Trevor is trying to put his shoe on and I politely hit a three in his face.”

Man oh man, "I don't know what his toes are thinking"?? Thanks Ron!

That, of course, was awesome.

Even more awesome though is Ron-Ron's explanation of what happened:

“Well what happened was…obviously I didn’t know his shoe would come off that’s the first thing conservative reporters. I didn’t know his shoe was gonna come off. I don’t speak to his feet so I don’t know what his feet are thinking, I don’t know what his toes are thinking, I don’t know what he’s thinking. Then his shoe comes off and I’m like okay a shoe is not supposed to be on the basketball court without somebody standing inside of it. So I said alright, I’m just gonna buy me some time. I really didn’t know whose shoe it was, but I said it has to be one of the player’s shoe. As soon as I toss it off the court, not throw into the stands which some people said, it’ll buy me some time. What happens is I come back down, Trevor is trying to put his shoe on and I politely hit a three in his face.”

Man oh man, "I don't know what his toes are thinking"?? Thanks Ron!

Tanks on the borders of....Colombia?

Everyone's favorite autocrat, Hugo F. Chavez, is mobilizing his military to the Colombian border to heroically repel the expected US invasion.

Ok, now repeat after me: WTF?

Seriously, Hugo, Wassup?

Well, now that he has more or less achieved total power, Venezuela is falling apart. Output there is still sharply falling and inflation is around 30%. Plus the country is facing water shortages and electricity blackouts. Crime in Caracas is a huge problem.

Although polls in Venezuela vary greatly, Chavez's popularity seems to be significantly falling in the face of all these problems.

I guess there is nothing like a good war scare to divert the populace from blaming you for the deterioration of their quality of life.

Ok, now repeat after me: WTF?

Seriously, Hugo, Wassup?

Well, now that he has more or less achieved total power, Venezuela is falling apart. Output there is still sharply falling and inflation is around 30%. Plus the country is facing water shortages and electricity blackouts. Crime in Caracas is a huge problem.

Although polls in Venezuela vary greatly, Chavez's popularity seems to be significantly falling in the face of all these problems.

I guess there is nothing like a good war scare to divert the populace from blaming you for the deterioration of their quality of life.

Still it's hard to believe that anyone would seriously expect the US to invade Venezuela. How could we ever get mad at this guy?

Wednesday, November 18, 2009

Anonybaby!

Anonywife is pregnant with a beautiful Anonybaby, a boy!

Anonyman, of course, just watched the sonogram. (I think that is how the conception happened, also, knowing Anonyman).

But, seriously, congrats to the whole Anonyfamily! We hope the pregnancy goes well...

Anonyman, of course, just watched the sonogram. (I think that is how the conception happened, also, knowing Anonyman).

But, seriously, congrats to the whole Anonyfamily! We hope the pregnancy goes well...

Tommy the Brit Scores a Double!

Tommy the Wannabe Brit is now OFFICIALLY a Brit, a REAL boy now.

First, and less important, he scored 350,000 pounds of Brit-cash, to run research.

Second, he passed his driving test! Now he can menace old ladies and bother the horses.

That'll do, Tom!

First, and less important, he scored 350,000 pounds of Brit-cash, to run research.

Second, he passed his driving test! Now he can menace old ladies and bother the horses.

That'll do, Tom!

Somali Pirates 0, Maersk Alabama 2

Pirates attack again. Pirates get beaten.

Perhaps we should ALL have automatic weapons, yes? To repel pirates.

Perhaps we should ALL have automatic weapons, yes? To repel pirates.

Tuesday, November 17, 2009

Fox News

I happened to flip over to Fox News when I was finishing my time on the elliptical machine in the living room.

They had an interview with some schmoe, talking about S. Palin's book, GOING ROGUE.

Only they had it spelled, GOING ROUGE. I think would have been a better title for the book, frankly. She uses quite a bit of make-up.

They had an interview with some schmoe, talking about S. Palin's book, GOING ROGUE.

Only they had it spelled, GOING ROUGE. I think would have been a better title for the book, frankly. She uses quite a bit of make-up.

Lateness

A little piece on lateness, for the Chronicle of Higher Education.

My favorite part is the reactions. Check this exchange, from the Chronicle comments section:

6. ridicula - November 16, 2009 at 11:31 am Mr Munger and referee101--who died and made you the gods of punctuality? When you obsess over and enrage yourselves over such things, you create an ugly work environment.

I suppose you both live in perfect worlds where nothing ever transpires to make you late, that you've had all bodily orifices sealed, have no family, no material reality to deal with whatsoever. You've never had a pimple or cut yourself shaving. You never speak to strangers. In fact, you must live in a space-time loophole from which you magically emerge whenever you have an appointment, spending the rest of your time in a state of suspended animation.

7. _perplexed_ - November 16, 2009 at 12:10 pm --hope I'm never on a committee with ridicula...

8. ridicula - November 16, 2009 at 12:34 pm --as I, in turn, hope I'm never on a committee

9. superdude - November 16, 2009 at 12:40 pm --Ridicula: No, an ugly work environment is caused by selfish people and one key sign of selfishness is being late. Late people have no concept of the value of everyone else's time and are by definition not team players.

As Head, I have strong expectations regarding punctuality. If I schedule a meeting for 3pm, it STARTS at 3pm, which means you need to have your butt in a chair BEFORE 3pm. I refuse to have a committee held hostage to someone who is late.

My own thoughts, for "ridicula":

1. Nice name. It fits.

2. As I read and reread your comment, trying to figure out what it means...I fail. I haven't obsessed over lateness, but I do find it amusing.

3. Because you see, it is easy to overcome all of the problems you list. Just leave earlier. That's it. The solution to being late is to leave earlier. Then even if you do have to go potty, you'll have time. And I'm pretty confident that you are not, in fact, busier than I am. You aren't busy at all. You are a crackpot.

4. To be fair, I see your game, though, Ridicula. It is to shirk and misbehave so badly as to avoid, as you admit freely, ever having to serve on a committee. And though I don't know you well, what I can see makes me think that having you NOT be in a position to impose your judgment on others is a nice equilibrium.

My favorite part is the reactions. Check this exchange, from the Chronicle comments section:

6. ridicula - November 16, 2009 at 11:31 am Mr Munger and referee101--who died and made you the gods of punctuality? When you obsess over and enrage yourselves over such things, you create an ugly work environment.

I suppose you both live in perfect worlds where nothing ever transpires to make you late, that you've had all bodily orifices sealed, have no family, no material reality to deal with whatsoever. You've never had a pimple or cut yourself shaving. You never speak to strangers. In fact, you must live in a space-time loophole from which you magically emerge whenever you have an appointment, spending the rest of your time in a state of suspended animation.

7. _perplexed_ - November 16, 2009 at 12:10 pm --hope I'm never on a committee with ridicula...

8. ridicula - November 16, 2009 at 12:34 pm --as I, in turn, hope I'm never on a committee

9. superdude - November 16, 2009 at 12:40 pm --Ridicula: No, an ugly work environment is caused by selfish people and one key sign of selfishness is being late. Late people have no concept of the value of everyone else's time and are by definition not team players.

As Head, I have strong expectations regarding punctuality. If I schedule a meeting for 3pm, it STARTS at 3pm, which means you need to have your butt in a chair BEFORE 3pm. I refuse to have a committee held hostage to someone who is late.

My own thoughts, for "ridicula":

1. Nice name. It fits.

2. As I read and reread your comment, trying to figure out what it means...I fail. I haven't obsessed over lateness, but I do find it amusing.

3. Because you see, it is easy to overcome all of the problems you list. Just leave earlier. That's it. The solution to being late is to leave earlier. Then even if you do have to go potty, you'll have time. And I'm pretty confident that you are not, in fact, busier than I am. You aren't busy at all. You are a crackpot.

4. To be fair, I see your game, though, Ridicula. It is to shirk and misbehave so badly as to avoid, as you admit freely, ever having to serve on a committee. And though I don't know you well, what I can see makes me think that having you NOT be in a position to impose your judgment on others is a nice equilibrium.

Ezra Klein is a tease

I saw the headline of his article, "The $900 Billion Mistake" and I thought to myself, right on dude! You have come to your senses. Of course I shoulda knowed better; the mistake the article laments is limiting the cost of health insurance reform to only $900 billion!

Yes, according to Ezra:

"The problem is that the number, which was chosen at a point of political weakness for health-care reform and the Obama administration, is too low. Most experts think you need closer to $1.1 trillion for a truly affordable plan. Limiting yourself to $900 billion ensures that the subsidies won't be quite where you need them to be..."

Now I am just a dumb Okie, but that is not my understanding of what the word "affordable" means. I never knew it could mean "more expensive"

Yes, according to Ezra:

"The problem is that the number, which was chosen at a point of political weakness for health-care reform and the Obama administration, is too low. Most experts think you need closer to $1.1 trillion for a truly affordable plan. Limiting yourself to $900 billion ensures that the subsidies won't be quite where you need them to be..."

Now I am just a dumb Okie, but that is not my understanding of what the word "affordable" means. I never knew it could mean "more expensive"

My nomination for Law Enforcement Officer of the Year!

Money quote: "time is going really really slowly!"

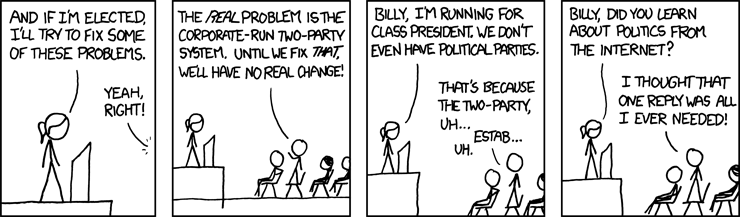

On political competition

Tyler had a interesting post yesterday about how increasing political competition via increasing the number of political parties is unlikely to bring about the same kind of improvements that increasing competition in the economic realm does.

I think he is right on the mark here.

However, there is another important dimension to political competition; viz polities compete with each other.

In the US, States implicitly are competing against each other for residents, businesses, jobs, etc.

In fact, if there is one thing Mark Crain taught me, it is that the States are hothouses of political innovations that often catch on and diffuse across the country.

Having our political system less centralized would allow inter-state competition to produce potential innovations in more spheres of policy.

In a way, devolving more functions of governance to the states increases competition over those functions in a way that is at least somewhat analogous to increasing competition in the economic realm.

Monday, November 16, 2009

Reading

Some books I have read recently.

Charles Euchner, THE LAST NINE INNINGS. My bud Russ Roberts sent me this, and it was great. The last game of the 2001 World Series, where the Yankees LOST (HA!). Divided up into different parts of the game, at a micro-level. Excellent. But then I went back and reread another book that has some of the same approach, George Will, MEN AT WORK. The stuff on Tony LaRussa, I had forgotten, very interesting.

Rose George, THE BIG NECESSITY: THE UNMENTIONABLE WORLD OF HUMAN WASTE AND WHY IT MATTERS. Terrific, interesting book. Core questions--why do we take many streams of wastewater, combine them, and then try to clean them? In fact, why so much emphasis on water-borne sanitation? Finally, why so much emphasis on "clean water" when the real problem is "handle poop better"? (well, not "handle," exactly, but manage). A very interesting and useful book.

Amity Shlaes, THE FORGOTTEN MAN: A NEW HISTORY OF THE GREAT DEPRESSION. Well written, interesting, and an entirely different view of the motives, methods, and effects of the "New Deal." Read it to see where we may be headed, again.

James Protzman, JESUS SWEPT. An odd book, local fiction about Jesus returning to Earth as an itinerant sweeper. Yep, sounds bizarre, and it is, but it works pretty well. I liked it a lot. Very quirky.

Hunter Thompson, FEAR AND LOATHING IN LAS VEGAS. I hadn't read it in years. It holds up pretty well.

Charles Euchner, THE LAST NINE INNINGS. My bud Russ Roberts sent me this, and it was great. The last game of the 2001 World Series, where the Yankees LOST (HA!). Divided up into different parts of the game, at a micro-level. Excellent. But then I went back and reread another book that has some of the same approach, George Will, MEN AT WORK. The stuff on Tony LaRussa, I had forgotten, very interesting.

Rose George, THE BIG NECESSITY: THE UNMENTIONABLE WORLD OF HUMAN WASTE AND WHY IT MATTERS. Terrific, interesting book. Core questions--why do we take many streams of wastewater, combine them, and then try to clean them? In fact, why so much emphasis on water-borne sanitation? Finally, why so much emphasis on "clean water" when the real problem is "handle poop better"? (well, not "handle," exactly, but manage). A very interesting and useful book.

Amity Shlaes, THE FORGOTTEN MAN: A NEW HISTORY OF THE GREAT DEPRESSION. Well written, interesting, and an entirely different view of the motives, methods, and effects of the "New Deal." Read it to see where we may be headed, again.

James Protzman, JESUS SWEPT. An odd book, local fiction about Jesus returning to Earth as an itinerant sweeper. Yep, sounds bizarre, and it is, but it works pretty well. I liked it a lot. Very quirky.

Hunter Thompson, FEAR AND LOATHING IN LAS VEGAS. I hadn't read it in years. It holds up pretty well.

Sunday, November 15, 2009

How Many Citizens Does It Take to Choose a Lightbulb?

Trick question: you don't GET to choose your own light bulb.

Interesting story. Just gets better and better, as it develops.

As the story concludes....

Call your senators and your congressional representative instead. Tell them you've had enough of command-economy enviro-thuggery. And invite them to put cap-and-trade in a place where a solar array would be both impractical and painful.

(Nod to North Ohio Boy)

Interesting story. Just gets better and better, as it develops.

As the story concludes....

Call your senators and your congressional representative instead. Tell them you've had enough of command-economy enviro-thuggery. And invite them to put cap-and-trade in a place where a solar array would be both impractical and painful.

(Nod to North Ohio Boy)

Sumner and Krugman are both wrong

Or at the least way overoptimistic about what monetary policy can accomplish.

In that piece, Paul avers that the first best monetary policy would be a Sumnerian "credible commitment to higher inflation". Why? "In order to reduce real interest rates".

People, it is just not clear that is possible, or if possible, it may be so in only a very limited sense.

Can the Fed set the real interest rate at whatever value it wants? I don't think so.

Do you think they could simultaneously credibly commit to say 10% inflation and successfully hold the nominal interest rate at zero? Me neither.

What about the simultaneous achievement of 5% expected inflation and a zero nominal interest rate? Doubtful at best.

The bottom line is that Fed can target the nominal rate or the inflation rate, but they simply cannot have independent targets for each. That is a basic message of the huge "instruments & targets" policymaking literature that appears to be lost in the current debate.

Saturday, November 14, 2009

Lock the Barnes Door--Blue Heaven!

Harrison Barnes does the right thing, and heads for Carolina. I have seen him listed anywhere from 6'6" to 6'8", but no matter what he is mighty.

Ol' Roy has, again, the best recruiting class in the ACC, and top 3 in the nation.

Three years from now, you'll see Harrison Barnes and my Carolinas in the Final Four again. This year could be sketchy, unless Ginyard and Davis really come up big. But three years from now....

Mark it down.

(Cute story, about Barnes' mom taping Michael Jordan, before Harrison was even born.)

Ol' Roy has, again, the best recruiting class in the ACC, and top 3 in the nation.

Three years from now, you'll see Harrison Barnes and my Carolinas in the Final Four again. This year could be sketchy, unless Ginyard and Davis really come up big. But three years from now....

Mark it down.

(Cute story, about Barnes' mom taping Michael Jordan, before Harrison was even born.)

An Important Announcement

Remarkably, a large number of folks in North Carolina have gotten big headlines, simply by announcing that each of them is NOT going to seek the Democratic nomination to run against US Senator Richard Burr, R-NC. Most recently, Rep. Bob Ethridge got big coverage for this staged non-announcement.

Well, okay, here goes. A press release.

RALEIGH: Dr. Michael Munger, Chair of Political Science at Duke and former (2008) candidate for North Carolina Governor, made an important announcement today.

"After thinking it over, and talking to my wife and family, I have decided NOT to seek the Democratic nomination for Senator. There were many considerations, not the least of which is that I am not a registered Democrat, and therefore am ineligible to run. But I am also hoping to spend more time at home now, and having to live in Washington as a Senator would get in the way of all that."

Munger has agreed that he will not endorse anyone in the Democratic primary, after thinking it over for about 3 seconds. "They are all crooks, why would I endorse one of them?" he asked.

(UPDATE: Note--the above was edited to acknowledge reader suggestions...)

Well, okay, here goes. A press release.

RALEIGH: Dr. Michael Munger, Chair of Political Science at Duke and former (2008) candidate for North Carolina Governor, made an important announcement today.

"After thinking it over, and talking to my wife and family, I have decided NOT to seek the Democratic nomination for Senator. There were many considerations, not the least of which is that I am not a registered Democrat, and therefore am ineligible to run. But I am also hoping to spend more time at home now, and having to live in Washington as a Senator would get in the way of all that."

Munger has agreed that he will not endorse anyone in the Democratic primary, after thinking it over for about 3 seconds. "They are all crooks, why would I endorse one of them?" he asked.

(UPDATE: Note--the above was edited to acknowledge reader suggestions...)

Friday, November 13, 2009

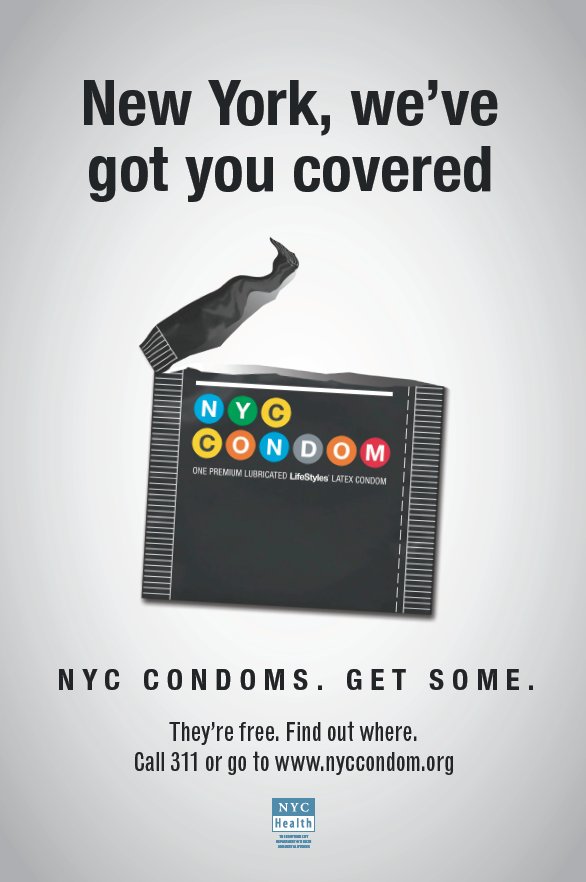

Spitzer's Raincoat is to Spitzer as NYC Condom is to....

When I first heard of the "NYC Condom," I thought it was just a metaphor for Eliot Spitzer's trenchcoat.

But apparently they are real. And, the subject of research.... The NYC Condom: Use and Acceptability of New York City's Branded Condom

The NYC Condom: Use and Acceptability of New York City's Branded Condom

Ryan Burke, Juliet Wilson, Kyle Bernstein, Nicholas Grosskopf, Christopher

Murrill, Blayne Cutler, Monica Sweeney & Elizabeth Begier

American Journal of Public Health, forthcoming

Abstract: We assessed awareness and experience with the NYC Condom via surveys at 7 public events targeting priority condom distribution populations during 2007. Most respondents (76%) were aware of NYC Condoms. Of those that had obtained them, 69% had used them. Most (80%) wanted alternative condoms offered for free: 22% wanted ultra-thin, 18% extra-strength, and 14% larger-size. Six months after the NYC Condom launch, we found high levels of awareness and use. Because many wanted alternative condoms, the Department of Health and Mental Hygiene began distributing the 3 most-requested alternatives.

But apparently they are real. And, the subject of research....

The NYC Condom: Use and Acceptability of New York City's Branded Condom

The NYC Condom: Use and Acceptability of New York City's Branded CondomRyan Burke, Juliet Wilson, Kyle Bernstein, Nicholas Grosskopf, Christopher

Murrill, Blayne Cutler, Monica Sweeney & Elizabeth Begier

American Journal of Public Health, forthcoming

Abstract: We assessed awareness and experience with the NYC Condom via surveys at 7 public events targeting priority condom distribution populations during 2007. Most respondents (76%) were aware of NYC Condoms. Of those that had obtained them, 69% had used them. Most (80%) wanted alternative condoms offered for free: 22% wanted ultra-thin, 18% extra-strength, and 14% larger-size. Six months after the NYC Condom launch, we found high levels of awareness and use. Because many wanted alternative condoms, the Department of Health and Mental Hygiene began distributing the 3 most-requested alternatives.

No Money for Nothing, And Your Chicks For Free

This woman lives without money.

If everyone in Germany tried this the welfare state would collapse, since it is much harder for the state to expropriate in a barter economy.

So, while this woman seems very proud of herself, all this really is is a big tax evasion scheme.

To which I say: YOU GO, GIRL! Bring down the German government!

If everyone in Germany tried this the welfare state would collapse, since it is much harder for the state to expropriate in a barter economy.

So, while this woman seems very proud of herself, all this really is is a big tax evasion scheme.

To which I say: YOU GO, GIRL! Bring down the German government!

There Are No Atheists in Foxholes, Or Singles Bars

It is said that there are no atheists in foxholes.

There are apparently no atheists in singles bars, either.

Mating Competitors Increase Religious Beliefs

Yexin Jessica Li, Adam Cohen, Jason Weeden & Douglas Kenrick. Journal of Experimental Social Psychology, forthcoming

Abstract: It has been presumed that religiosity has an influence on mating behavior, but here we experimentally investigate the possibility that mating behavior might also influence religiosity. In Experiment 1, people reported higher religiosity after looking at mating pools consisting of attractive people of their own sex compared to attractive opposite sex targets. Experiment 2 replicated the effect with an added control group, and suggested that both men and women become more religious when seeing same sex competitors. We discuss several possible explanations for these effects. Most broadly, the findings contribute to an emerging literature on how cultural phenomena such as religiosity respond to ecological cues in potentially functional ways.

(Nod to Kevin L, who could be an atheist anywhere, he's that brave)

There are apparently no atheists in singles bars, either.

Mating Competitors Increase Religious Beliefs

Yexin Jessica Li, Adam Cohen, Jason Weeden & Douglas Kenrick. Journal of Experimental Social Psychology, forthcoming