Golly, this is remarkable. Click through for commentary...

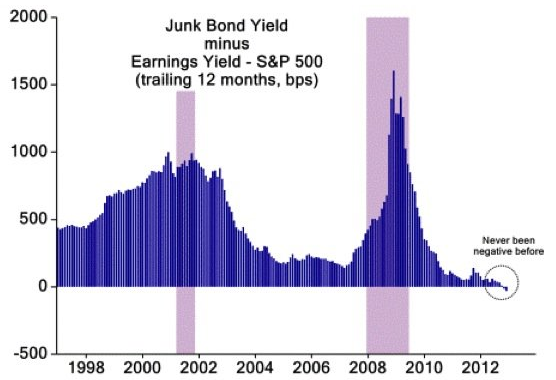

As Woj puts it: This chart, more than almost any other, may highlight the potential harm induced by the Federal Reserve’s attempts to push private investors further out on the risk spectrum. Unless junk bond companies have truly become significantly less risky, when the next round of increasing defaults begins, investors will find that current yields fail to even remotely compensate for future losses. Stocks may currently be slightly overvalued from a historical perspective, but certainly not compared with junk bonds.

John-O: waddya thank, m'brother?

As Woj puts it: This chart, more than almost any other, may highlight the potential harm induced by the Federal Reserve’s attempts to push private investors further out on the risk spectrum. Unless junk bond companies have truly become significantly less risky, when the next round of increasing defaults begins, investors will find that current yields fail to even remotely compensate for future losses. Stocks may currently be slightly overvalued from a historical perspective, but certainly not compared with junk bonds.

John-O: waddya thank, m'brother?

No comments:

Post a Comment