Monday, December 31, 2012

Holy Negative Spread, Batman!

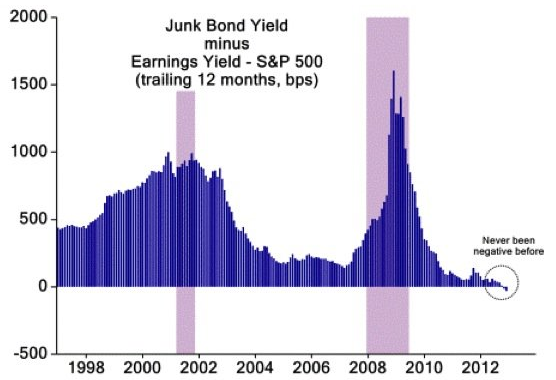

Golly, this is remarkable. Click through for commentary...

As Woj puts it: This chart, more than almost any other, may highlight the potential harm induced by the Federal Reserve’s attempts to push private investors further out on the risk spectrum. Unless junk bond companies have truly become significantly less risky, when the next round of increasing defaults begins, investors will find that current yields fail to even remotely compensate for future losses. Stocks may currently be slightly overvalued from a historical perspective, but certainly not compared with junk bonds.

John-O: waddya thank, m'brother?

As Woj puts it: This chart, more than almost any other, may highlight the potential harm induced by the Federal Reserve’s attempts to push private investors further out on the risk spectrum. Unless junk bond companies have truly become significantly less risky, when the next round of increasing defaults begins, investors will find that current yields fail to even remotely compensate for future losses. Stocks may currently be slightly overvalued from a historical perspective, but certainly not compared with junk bonds.

John-O: waddya thank, m'brother?

Amazing Filibustration, and Some Smartness

I had to go all Boudreaux on an editorial cartoon. (It's not posted yet, I'll put it up when I can find it). (UPDATE: Here it is....)

Here is the letter I sent to the News and Observer, in outrage:

The 12/31 editorial cartoon (Morin) could have been funny. Old 2012 asks "Where's the 2013 baby?" And a clown dressed as Congress could say, "We're filibustering it." Now, only the Senate has filibusters; the House doesn’t allow them. But at least it would have been nonpartisan, focusing on a dysfunctional institution generically called “Congress” instead of "Senate" (controlled by Democrats) which is certainly dysfunctional. They have not even debated a formal budget bill since 2009. Would the Republicans have filibustered a budget bill? Hard to tell, since the Dems have failed even to bring a budget forward from committee for nearly four years. Still, just say "Congress" and be vague, or "Senate" and be correct. And funny. A little funny, at least.

Anyway, here's the thing. There is wisdom out there. This is the best thing I have seen on the cliff, the budget, etc. The BEST. Not surprisingly, it comes from LeBron, in his NYTimes column. What he said, folks. Excerpt:

Economic conservatives often stress the connection between low taxes and smaller government. But that observation, as an argument for lower current taxes, looks weaker as the years pass. Keeping taxes low doesn’t stop the growth of government spending and, indeed, makes spending taste like a free lunch, because the bill is paid much later. The conservative strategy has long been to hold the line on taxes now, but it would be better to encourage the public to more readily grasp and internalize the costs of government spending.

As I say often, "conservative" once meant (1) question government spending, and (2) if money is to be spent, figure out how to pay for it responsibly. Since the Repubs decided #2 was unnecessary, we've all been in deep #2.

Here is the letter I sent to the News and Observer, in outrage:

The 12/31 editorial cartoon (Morin) could have been funny. Old 2012 asks "Where's the 2013 baby?" And a clown dressed as Congress could say, "We're filibustering it." Now, only the Senate has filibusters; the House doesn’t allow them. But at least it would have been nonpartisan, focusing on a dysfunctional institution generically called “Congress” instead of "Senate" (controlled by Democrats) which is certainly dysfunctional. They have not even debated a formal budget bill since 2009. Would the Republicans have filibustered a budget bill? Hard to tell, since the Dems have failed even to bring a budget forward from committee for nearly four years. Still, just say "Congress" and be vague, or "Senate" and be correct. And funny. A little funny, at least.

But the cartoon didn’t say “Congress.” Could it be because the Democrats control

the Senate? The clown had to be labeled

“HOUSE Tea Party.” Two problems. First, no House filibusters. Plus, your "Tea Party" bogeyman has a majority in the House. Why would they filibuster? I wouldn't accept this mistake from a high school senior in a remedial civics class.

Second, this is partisan claptrap. Congress, both chambers, is gridlocked by an appalling leadership vacuum, from both idiotic parties. But instead of pointing that out, you selected a cartoon with a factually mistaken, needlessly partisan message.

Second, this is partisan claptrap. Congress, both chambers, is gridlocked by an appalling leadership vacuum, from both idiotic parties. But instead of pointing that out, you selected a cartoon with a factually mistaken, needlessly partisan message.

I sincerely hope that your editorial staff intentionally

chose partisanship over accuracy in selecting that cartoon. Because the alternative is worse: you folks charged with “leading” public

opinion about politics don’t understand the basics of Congressional procedure.

Sincerely, MCM etc.

Sincerely, MCM etc.

Anyway, here's the thing. There is wisdom out there. This is the best thing I have seen on the cliff, the budget, etc. The BEST. Not surprisingly, it comes from LeBron, in his NYTimes column. What he said, folks. Excerpt:

Economic conservatives often stress the connection between low taxes and smaller government. But that observation, as an argument for lower current taxes, looks weaker as the years pass. Keeping taxes low doesn’t stop the growth of government spending and, indeed, makes spending taste like a free lunch, because the bill is paid much later. The conservative strategy has long been to hold the line on taxes now, but it would be better to encourage the public to more readily grasp and internalize the costs of government spending.

As I say often, "conservative" once meant (1) question government spending, and (2) if money is to be spent, figure out how to pay for it responsibly. Since the Repubs decided #2 was unnecessary, we've all been in deep #2.

Sunday, December 30, 2012

One

Took the EYM out for dinner for his birthday. He is 23 now. Amazing.

Anyway, here was the EYM last night, at the restaurant he picked, ONE, in Chapel Hill. An interesting place.

That's dessert, by the way. "Eggs and Toast." Here is the description, from the menu:

Anyway, here was the EYM last night, at the restaurant he picked, ONE, in Chapel Hill. An interesting place.

That's dessert, by the way. "Eggs and Toast." Here is the description, from the menu:

“Eggs and Toast” Coconut-Guava Panna Cotta, Passion Fruit Yolk”, Brioche, Pineapple Confiture, Horchata Ice Cream, Rice Milk Espuma

Robert Higgs, Libertarian

A really excellent, contemplative piece by my friend Bob Higgs.

Excerpt:

...after the more recent decades of my libertarian journey, I am now struck by a different aspect of this longstanding debate, which has to do with our strategy for winning people over to libertarianism. Strategy 1 is to persuade them that freedom works, that a free society will be richer and otherwise better off than an unfree society; that a free market will, as it were, cause the trains to run on time better than a government bureaucracy will do so. Strategy 2 is to persuade people that no one, not even a government functionary, has a just right to interfere with innocent people’s freedom of action; that none of us was born with a saddle on his back to accommodate someone else’s riding him.

In our world, so many people have been confused or misled by faulty claims about morality and justice that most libertarians, especially in the think tanks and other organizations that carry much of the burden of education about libertarianism, concentrate their efforts on pursuing Strategy 1 as effectively as possible. Hence, they produce policy studies galore, each showing how the government has fouled up a market or another situation by its ostensibly well-intentioned laws and regulations. Of course, the 98 percent or more of society (especially in its political aspect) that in one way or another opposes perfect freedom responds with policy studies of its own, each showing why an alleged “market failure,” “social injustice,” or other problem warrants the government’s interference with people’s freedom of action and each promising to remedy the perceived evils. Anyone who pays attention to policy debates is familiar with the ensuing, never-ending war of the wonks. I myself have done a fair amount of such work, so I am not condemning it. As one continues to expose the defects of anti-freedom arguments and the failures of government efforts to “solve” a host of problems, one hopes that someone will be persuaded and become willing to give freedom a chance.

I am reminded of H.L. Mencken's definition of "progressive democracy:"

"It [is impossible] to separate the democratic idea from the theory that there is a mystical merit, an esoteric and ineradicable rectitude, in the man at the bottom of the scale—that inferiority, by some strange magic, becomes superiority—nay, the superiority of superiorities. What baffles statesmen is to be solved by the people, instantly and by a sort of seraphic intuition. This notion . . . originated in the poetic fancy of gentlemen on the upper levels— sentimentalists who, observing to their distress that the ass was overladen, proposed to reform transportation by putting him in the cart." (H.L. Mencken, from Notes on Democracy, 1926)

Excerpt:

...after the more recent decades of my libertarian journey, I am now struck by a different aspect of this longstanding debate, which has to do with our strategy for winning people over to libertarianism. Strategy 1 is to persuade them that freedom works, that a free society will be richer and otherwise better off than an unfree society; that a free market will, as it were, cause the trains to run on time better than a government bureaucracy will do so. Strategy 2 is to persuade people that no one, not even a government functionary, has a just right to interfere with innocent people’s freedom of action; that none of us was born with a saddle on his back to accommodate someone else’s riding him.

In our world, so many people have been confused or misled by faulty claims about morality and justice that most libertarians, especially in the think tanks and other organizations that carry much of the burden of education about libertarianism, concentrate their efforts on pursuing Strategy 1 as effectively as possible. Hence, they produce policy studies galore, each showing how the government has fouled up a market or another situation by its ostensibly well-intentioned laws and regulations. Of course, the 98 percent or more of society (especially in its political aspect) that in one way or another opposes perfect freedom responds with policy studies of its own, each showing why an alleged “market failure,” “social injustice,” or other problem warrants the government’s interference with people’s freedom of action and each promising to remedy the perceived evils. Anyone who pays attention to policy debates is familiar with the ensuing, never-ending war of the wonks. I myself have done a fair amount of such work, so I am not condemning it. As one continues to expose the defects of anti-freedom arguments and the failures of government efforts to “solve” a host of problems, one hopes that someone will be persuaded and become willing to give freedom a chance.

I am reminded of H.L. Mencken's definition of "progressive democracy:"

"It [is impossible] to separate the democratic idea from the theory that there is a mystical merit, an esoteric and ineradicable rectitude, in the man at the bottom of the scale—that inferiority, by some strange magic, becomes superiority—nay, the superiority of superiorities. What baffles statesmen is to be solved by the people, instantly and by a sort of seraphic intuition. This notion . . . originated in the poetic fancy of gentlemen on the upper levels— sentimentalists who, observing to their distress that the ass was overladen, proposed to reform transportation by putting him in the cart." (H.L. Mencken, from Notes on Democracy, 1926)

The 5 most popular Angus KPC posts of 2012

The following were the five most viewed posts of mine this past year.

I am impressed. Two about economics, one about academics, one about sports and only one total goofball post.

Football: Stick a fork in it?

Me and LeBron's "what would the end of football look like?" piece in Grantland lives on as the horrific evidence grows.

The edited volume blues

People, you can't get something for nothing. If you are not yet where you want to be in academia, stay away from edited volumes, special issues of journals, festschrifts, and the like.

When cannons are outlawed....

Anytime I can legitimately post a Breeder's video, it's a good day. I guess I should feel bad about someone actually dying, but being taken out by a "homemade" cannonball cannot go un-mocked in my world.

Eyes wide shut

I am a big proponent of evaluating aid projects, but a bit skeptical of the grand claims sometimes made by the Randomista contingent. This paper about pseudo placebo effects in RCTs really caught my attention.

The Economy & Presidential Elections

"BHO is going to win in November DESPITE the economy, largely because Romney is a terrible candidate who is running an undisciplined, juvenile, brain-damaged campaign.

And that matters."

Thanks for indulging me and Mungo and we will endeavor to bring you even more gonzo-econo-blogging in 2013. We'll be back with more stuff.

I am impressed. Two about economics, one about academics, one about sports and only one total goofball post.

Football: Stick a fork in it?

Me and LeBron's "what would the end of football look like?" piece in Grantland lives on as the horrific evidence grows.

The edited volume blues

People, you can't get something for nothing. If you are not yet where you want to be in academia, stay away from edited volumes, special issues of journals, festschrifts, and the like.

When cannons are outlawed....

Anytime I can legitimately post a Breeder's video, it's a good day. I guess I should feel bad about someone actually dying, but being taken out by a "homemade" cannonball cannot go un-mocked in my world.

Eyes wide shut

I am a big proponent of evaluating aid projects, but a bit skeptical of the grand claims sometimes made by the Randomista contingent. This paper about pseudo placebo effects in RCTs really caught my attention.

The Economy & Presidential Elections

"BHO is going to win in November DESPITE the economy, largely because Romney is a terrible candidate who is running an undisciplined, juvenile, brain-damaged campaign.

And that matters."

Thanks for indulging me and Mungo and we will endeavor to bring you even more gonzo-econo-blogging in 2013. We'll be back with more stuff.

$$ can't buy happiness, but do happy people make more $$?

Estimating the influence of life satisfaction and positive affect on later income using sibling fixed effects

Jan-Emmanuel De Neve & Andrew Oswald

Proceedings of the National Academy of Sciences, 4 December 2012, Pages 19953-19958

Abstract:

The question of whether there is a connection between income and psychological well-being is a long-studied issue across the social, psychological, and behavioral sciences. Much research has found that richer people tend to be happier. However, relatively little attention has been paid to whether happier individuals perform better financially in the first place. This possibility of reverse causality is arguably understudied. Using data from a large US representative panel, we show that adolescents and young adults who report higher life satisfaction or positive affect grow up to earn significantly higher levels of income later in life. We focus on earnings approximately one decade after the person’s well-being is measured; we exploit the availability of sibling clusters to introduce family fixed effects; we account for the human capacity to imagine later socioeconomic outcomes and to anticipate the resulting feelings in current well-being. The study’s results are robust to the inclusion of controls such as education, intelligence quotient, physical health, height, self-esteem, and later happiness. We consider how psychological well-being may influence income. Sobel–Goodman mediation tests reveal direct and indirect effects that carry the influence from happiness to income. Significant mediating pathways include a higher probability of obtaining a college degree, getting hired and promoted, having higher degrees of optimism and extraversion, and less neuroticism.

Nod to Kevin Lewis

Jan-Emmanuel De Neve & Andrew Oswald

Proceedings of the National Academy of Sciences, 4 December 2012, Pages 19953-19958

Abstract:

The question of whether there is a connection between income and psychological well-being is a long-studied issue across the social, psychological, and behavioral sciences. Much research has found that richer people tend to be happier. However, relatively little attention has been paid to whether happier individuals perform better financially in the first place. This possibility of reverse causality is arguably understudied. Using data from a large US representative panel, we show that adolescents and young adults who report higher life satisfaction or positive affect grow up to earn significantly higher levels of income later in life. We focus on earnings approximately one decade after the person’s well-being is measured; we exploit the availability of sibling clusters to introduce family fixed effects; we account for the human capacity to imagine later socioeconomic outcomes and to anticipate the resulting feelings in current well-being. The study’s results are robust to the inclusion of controls such as education, intelligence quotient, physical health, height, self-esteem, and later happiness. We consider how psychological well-being may influence income. Sobel–Goodman mediation tests reveal direct and indirect effects that carry the influence from happiness to income. Significant mediating pathways include a higher probability of obtaining a college degree, getting hired and promoted, having higher degrees of optimism and extraversion, and less neuroticism.

Nod to Kevin Lewis

Saturday, December 29, 2012

Schmidtz

Wow. David Schmidtz has totally blown up, gotten big, become famous, etc. The problem is, you know what happens when you get all famous? This.

Looks a lot like this, doesn't it? I'm just sayin'...

Fortunately, David is a kind and benevolent ruler. And all that stuff where Dave insists that Jerry Gaus call him "Chancellor"? It doesn't mean anything, I'm sure.

Looks a lot like this, doesn't it? I'm just sayin'...

Fortunately, David is a kind and benevolent ruler. And all that stuff where Dave insists that Jerry Gaus call him "Chancellor"? It doesn't mean anything, I'm sure.

We Can Do This, But It Makes Warming Worse

Adapting to Climate Change: The Remarkable Decline in the U.S. Temperature-Mortality Relationship Over the 20th Century

Alan Barreca et al.

MIT Working Paper, December 2012

Abstract:

Adaptation is the only strategy that is guaranteed to be part of the world's climate strategy. Using the most comprehensive set of data files ever compiled on mortality and its determinants over the course of the 20th century, this paper makes two primary discoveries. First, we find that the mortality effect of an extremely hot day declined by about 80% between 1900-1959 and 1960-2004. As a consequence, days with temperatures exceeding 90°F were responsible for about 600 premature fatalities annually in the 1960-2004 period, compared to the approximately 3,600 premature fatalities that would have occurred if the temperature-mortality relationship from before 1960 still prevailed. Second, the adoption of residential air conditioning (AC) explains essentially the entire decline in the temperature-mortality relationship. In contrast, increased access to electricity and health care seem not to affect mortality on extremely hot days. Residential AC appears to be both the most promising technology to help poor countries mitigate the temperature related mortality impacts of climate change and, because fossil fuels are the least expensive source of energy, a technology whose proliferation will speed up the rate of climate change.

Nod to Kevin Lewis

Alan Barreca et al.

MIT Working Paper, December 2012

Abstract:

Adaptation is the only strategy that is guaranteed to be part of the world's climate strategy. Using the most comprehensive set of data files ever compiled on mortality and its determinants over the course of the 20th century, this paper makes two primary discoveries. First, we find that the mortality effect of an extremely hot day declined by about 80% between 1900-1959 and 1960-2004. As a consequence, days with temperatures exceeding 90°F were responsible for about 600 premature fatalities annually in the 1960-2004 period, compared to the approximately 3,600 premature fatalities that would have occurred if the temperature-mortality relationship from before 1960 still prevailed. Second, the adoption of residential air conditioning (AC) explains essentially the entire decline in the temperature-mortality relationship. In contrast, increased access to electricity and health care seem not to affect mortality on extremely hot days. Residential AC appears to be both the most promising technology to help poor countries mitigate the temperature related mortality impacts of climate change and, because fossil fuels are the least expensive source of energy, a technology whose proliferation will speed up the rate of climate change.

Nod to Kevin Lewis

The nonsense math effect

The nonsense math effect

Kimmo Eriksson, Judgment and Decision Making, November 2012, Pages 746–749

Abstract: Mathematics is a fundamental tool of research. Although potentially applicable in every discipline, the amount of training in mathematics that students typically receive varies greatly between different disciplines. In those disciplines where most researchers do not master mathematics, the use of mathematics may be held in too much awe. To demonstrate this I conducted an online experiment with 200 participants, all of which had experience of reading research reports and a postgraduate degree (in any subject). Participants were presented with the abstracts from two published papers (one in evolutionary anthropology and one in sociology). Based on these abstracts, participants were asked to judge the quality of the research. Either one or the other of the two abstracts was manipulated through the inclusion of an extra sentence taken from a completely unrelated paper and presenting an equation that made no sense in the context. The abstract that

included the meaningless mathematics tended to be judged of higher quality. However, this "nonsense math effect" was not found among participants with degrees in mathematics, science, technology or medicine.

Interesting. Reminds me of this famous wannabe incident... Though from the other side, in a way. Sokal was using fake words to fool lit people. Eriksson is using fake math to fool social scientologists.

Nod to Kevin Lewis

Kimmo Eriksson, Judgment and Decision Making, November 2012, Pages 746–749

Abstract: Mathematics is a fundamental tool of research. Although potentially applicable in every discipline, the amount of training in mathematics that students typically receive varies greatly between different disciplines. In those disciplines where most researchers do not master mathematics, the use of mathematics may be held in too much awe. To demonstrate this I conducted an online experiment with 200 participants, all of which had experience of reading research reports and a postgraduate degree (in any subject). Participants were presented with the abstracts from two published papers (one in evolutionary anthropology and one in sociology). Based on these abstracts, participants were asked to judge the quality of the research. Either one or the other of the two abstracts was manipulated through the inclusion of an extra sentence taken from a completely unrelated paper and presenting an equation that made no sense in the context. The abstract that

included the meaningless mathematics tended to be judged of higher quality. However, this "nonsense math effect" was not found among participants with degrees in mathematics, science, technology or medicine.

Interesting. Reminds me of this famous wannabe incident... Though from the other side, in a way. Sokal was using fake words to fool lit people. Eriksson is using fake math to fool social scientologists.

Nod to Kevin Lewis

Friday, December 28, 2012

Upon further review......

I finally found the perfect KPC holiday picture:

(clic the pic for an even more career-ending image)

No real change in GDP, but we both ate s**t

Keynes and Krugman are walking down the street and see dog droppings.

Keynes says to Krugman: "I'll pay you $20,000 to eat those."

Krugman thinks about it, decides he really wants a ...new car, and eats the droppings.

They continue walking, then Krugman sees some other dog's droppings up ahead and says to Keynes: "Same deal: I'll pay you $20,000 to eat that."

Keynes didn't expect Krugman to take him up on his bet earlier, and he really needs the money, so he agrees.

Then Krugman says to Keynes: "We both have the same amount of money as before, but we both ate a lot of s**t."

Keynes replies: "Yeah, but there was $40,000 in stimulus to the national GDP."

Nod to Sid K.

Keynes says to Krugman: "I'll pay you $20,000 to eat those."

Krugman thinks about it, decides he really wants a ...new car, and eats the droppings.

They continue walking, then Krugman sees some other dog's droppings up ahead and says to Keynes: "Same deal: I'll pay you $20,000 to eat that."

Keynes didn't expect Krugman to take him up on his bet earlier, and he really needs the money, so he agrees.

Then Krugman says to Keynes: "We both have the same amount of money as before, but we both ate a lot of s**t."

Keynes replies: "Yeah, but there was $40,000 in stimulus to the national GDP."

Nod to Sid K.

Wind Power Fail

Measuring the Environmental Benefits of Wind Power

Joseph Cullen

American Economic Journal: Economic Policy, forthcoming

Abstract: Production subsidies for renewable energy, such as solar or wind power, are rationalized due to their perceived environmental benefits. Subsidizing these projects allows clean, renewable technologies to produce electricity that otherwise would have been produced by dirtier, fossil-fuel power plants. In this paper, I quantify the emissions offset by wind power for a large electricity grid in Texas using the randomness inherent in wind power availability. The results indicate that one MWh of wind power offsets negligible quantities of SO2, less than one lb of NOx, and less than half a ton of CO2. Only for high estimates of the social costs of pollution do I find that the value of emissions offset by wind power are greater than the renewable energy subsidies used to induce investment in wind farms.

Nod to Kevin Lewis

Joseph Cullen

American Economic Journal: Economic Policy, forthcoming

Abstract: Production subsidies for renewable energy, such as solar or wind power, are rationalized due to their perceived environmental benefits. Subsidizing these projects allows clean, renewable technologies to produce electricity that otherwise would have been produced by dirtier, fossil-fuel power plants. In this paper, I quantify the emissions offset by wind power for a large electricity grid in Texas using the randomness inherent in wind power availability. The results indicate that one MWh of wind power offsets negligible quantities of SO2, less than one lb of NOx, and less than half a ton of CO2. Only for high estimates of the social costs of pollution do I find that the value of emissions offset by wind power are greater than the renewable energy subsidies used to induce investment in wind farms.

Nod to Kevin Lewis

American Poetry and Private Real Property

American Poetry and Private Real Property

Eric Rawson, Journal of American Studies, forthcoming

Abstract: This article examines the ways in which American poetic practice and thematics map a conception of private real property as it has developed uniquely on the North American continent. I explore how the Land Ordinance of 1790, the Preemption Act, the Homestead Act, and other land-use policies shaped a conception of the developing landscape as divisible into a vast agglomeration of private enterprises mediated primarily by the transfer of title deeds. The impact of private real property beliefs and practices, I argue, has shaped both the practice and the reception of American poetry (and other cultural products) for at least the last 150 years. I incorporate the insights of cultural geography – particularly the work of John B. Jackson, Carl Sauer, and Scott Freundschuh – to understand how the last century's building practices and the reorganization of the landscape, particularly in western metropolitan areas, find imaginative expression in poetry. Although mine is not a law-in-literature approach, I contend that modern/postmodern poetry operates in a way that depends on the very exchange values of the late capitalist property system it often critiques.

Nod to Kevin Lewis

Eric Rawson, Journal of American Studies, forthcoming

Abstract: This article examines the ways in which American poetic practice and thematics map a conception of private real property as it has developed uniquely on the North American continent. I explore how the Land Ordinance of 1790, the Preemption Act, the Homestead Act, and other land-use policies shaped a conception of the developing landscape as divisible into a vast agglomeration of private enterprises mediated primarily by the transfer of title deeds. The impact of private real property beliefs and practices, I argue, has shaped both the practice and the reception of American poetry (and other cultural products) for at least the last 150 years. I incorporate the insights of cultural geography – particularly the work of John B. Jackson, Carl Sauer, and Scott Freundschuh – to understand how the last century's building practices and the reorganization of the landscape, particularly in western metropolitan areas, find imaginative expression in poetry. Although mine is not a law-in-literature approach, I contend that modern/postmodern poetry operates in a way that depends on the very exchange values of the late capitalist property system it often critiques.

Nod to Kevin Lewis

Thursday, December 27, 2012

Economics: Older Authors, More Original Data

Six Decades of Top Economics Publishing: Who and How?

Daniel Hamermesh

NBER Working Paper, December 2012

Abstract: Presenting data on all full-length articles published in the three top general economics journals for one year in each of the 1960s through 2010s, I analyze how patterns of co-authorship, age structure and methodology have changed, and what the possible causes of these changes may have been. The entire distribution of number of authors has shifted steadily rightward. In the last two decades the fraction of older authors has almost quadrupled. The top journals are now publishing many fewer papers that represent pure theory, regardless of sub-field, somewhat less empirical work based on publicly available data sets, and many more empirical studies based on data assembled for the study by the author(s) or on laboratory or field experiments.

I wonder if this is because the revolution in economics methods changed publication in the 1950s. Or was it just the new emphasis on publication, at all, that has now reached steady state? If that's true, then the new distribution is what we should expect, and the bias toward younger authors and low-hanging fruit data sets was short-lived.

Nod to Kevin Lewis

Daniel Hamermesh

NBER Working Paper, December 2012

Abstract: Presenting data on all full-length articles published in the three top general economics journals for one year in each of the 1960s through 2010s, I analyze how patterns of co-authorship, age structure and methodology have changed, and what the possible causes of these changes may have been. The entire distribution of number of authors has shifted steadily rightward. In the last two decades the fraction of older authors has almost quadrupled. The top journals are now publishing many fewer papers that represent pure theory, regardless of sub-field, somewhat less empirical work based on publicly available data sets, and many more empirical studies based on data assembled for the study by the author(s) or on laboratory or field experiments.

I wonder if this is because the revolution in economics methods changed publication in the 1950s. Or was it just the new emphasis on publication, at all, that has now reached steady state? If that's true, then the new distribution is what we should expect, and the bias toward younger authors and low-hanging fruit data sets was short-lived.

Nod to Kevin Lewis

Penn and Teller on Gun Control

This is worth watching. As always, Penn and Teller make some good points, some not as good points, and some things are just wrong. But it's interesting and well done.

UPDATE: I found this, over at Popehat (thanks, Patrick!). Disturbing on two levels. First, the presumption of doctors to think they have expertise on constitutional matters. Second, relatedly but still separate, the imperialistic tendency of medical mavens to try to treat any action they don't like, for whatever reason, as a "public health" problem. Ick.

UPDATE: I found this, over at Popehat (thanks, Patrick!). Disturbing on two levels. First, the presumption of doctors to think they have expertise on constitutional matters. Second, relatedly but still separate, the imperialistic tendency of medical mavens to try to treat any action they don't like, for whatever reason, as a "public health" problem. Ick.

Tidings of Comfort and Joy

1. NY Times has nothing better to do than troll-comment-post left coast bagelries.

2. This is disturbing. Because instead of complaining about the hundreds of innocent people our government intentionally kills in drone strikes, we get upset about dozens killed at random by crazy people. Apparently it's important to focus on chance, rather than intention. If you want the original video, it can be found by clicking bottom left of the redo.

3. G. Weeks on Latin American corruption.

4. The 4th Amendment applies to everyone. Unless you are poor. Then apparently the state owns you and your stuff, and can search whenever it wants, without cause. Because you are poor, and they are giving you money. Can you tell me again why it's better to be dependent on the state than to have a job?

5. Pete B on microfoundations.

6. Can you define "assault rifle"? The NY Times can't.

2. This is disturbing. Because instead of complaining about the hundreds of innocent people our government intentionally kills in drone strikes, we get upset about dozens killed at random by crazy people. Apparently it's important to focus on chance, rather than intention. If you want the original video, it can be found by clicking bottom left of the redo.

3. G. Weeks on Latin American corruption.

4. The 4th Amendment applies to everyone. Unless you are poor. Then apparently the state owns you and your stuff, and can search whenever it wants, without cause. Because you are poor, and they are giving you money. Can you tell me again why it's better to be dependent on the state than to have a job?

5. Pete B on microfoundations.

6. Can you define "assault rifle"? The NY Times can't.

Wednesday, December 26, 2012

Christmas Surprise

My wife and I have been married for more than 26 years. To each other.

Over that time the LMM and I have solved the problem of Christmas present anxiety, the problem you have when you aren't sure what to get the other person, even though you know that person very well, because you have already gotten that person pretty much everything that person has ever expressed an interest in.

Our solution has some humor to it. Each of us, for years, would choose things each liked, for ourselves, and then provide said thing to other person, not wrapped. Other person would wrap it and hide it away until the time was right. And both would feign pleasure and surprise at tree-and-present time, Christmas morning.

But that got old. So now the LMM takes it one more step. She buys stuff for herself, and wraps it herself, and then puts it under the tree and opens it herself. I never see it, until Christmas morning.

This year I asked if I could see the jewelry I got her. She said, "No, that will spoil the surprise." To be clear: That's MY surprise. At seeing what I got HER.

And the fact is that I take great pleasure, and am genuinely surprised, on Christmas morning. So, as usual, even though things may sound a little cockeyed at our house, the LMM is right, and all is well.

(I'm pretty sure Shirley will back the LMM up on this, in terms of logic. Right, Shirl?)

Over that time the LMM and I have solved the problem of Christmas present anxiety, the problem you have when you aren't sure what to get the other person, even though you know that person very well, because you have already gotten that person pretty much everything that person has ever expressed an interest in.

Our solution has some humor to it. Each of us, for years, would choose things each liked, for ourselves, and then provide said thing to other person, not wrapped. Other person would wrap it and hide it away until the time was right. And both would feign pleasure and surprise at tree-and-present time, Christmas morning.

But that got old. So now the LMM takes it one more step. She buys stuff for herself, and wraps it herself, and then puts it under the tree and opens it herself. I never see it, until Christmas morning.

This year I asked if I could see the jewelry I got her. She said, "No, that will spoil the surprise." To be clear: That's MY surprise. At seeing what I got HER.

And the fact is that I take great pleasure, and am genuinely surprised, on Christmas morning. So, as usual, even though things may sound a little cockeyed at our house, the LMM is right, and all is well.

(I'm pretty sure Shirley will back the LMM up on this, in terms of logic. Right, Shirl?)

Nothing to add

Nothing to add to this little gem. The headline says it all, but it's worth savoring, like fresh hot pancakes on a cold winter day.

Nod to Tommy the Tenured Brit.

Why Does Canada Have a Maple Syrup Cartel?

Nod to Tommy the Tenured Brit.

Tuesday, December 25, 2012

The Ghost of Christmas Yet to Come: Sovereign Debt

From Chapter IV of "A Christmas Carol"

The Spirit stood among the graves, and pointed down to One. He advanced towards it trembling. The Phantom was exactly as it had been, but he dreaded that he saw new meaning in its solemn shape.

``Before I draw nearer to that stone to which you point,'' said Scrooge, ``answer me one question. Are these the shadows of the things that Will be, or are they shadows of things that May be, only?''

Still the Ghost pointed downward to the grave by which it stood.

``Men's courses will foreshadow certain ends, to which, if persevered in, they must lead,'' said Scrooge. ``But if the courses be departed from, the ends will change. Say it is thus with what you show me!''

The Spirit was immovable as ever. Scrooge crept towards it, trembling as he went; and following the finger, read upon the stone of the neglected grave his own name,

Ebenezer Scrooge.

``Am I that man who lay upon the bed?'' he cried, upon his knees.

The finger pointed from the grave to him, and back again.

``No, Spirit! Oh no, no!'' The finger still was there.

``Spirit!'' he cried, tight clutching at its robe, ``hear me! I am not the man I was. I will not be the man I must have been but for this intercourse. Why show me this, if I am past all hope?''

For the first time the hand appeared to shake.

``Good Spirit,'' he pursued, as down upon the ground he fell before it: ``Your nature intercedes for me, and pities me. Assure me that I yet may change these shadows you have shown me, by an altered budget plan, one that raises taxes and cuts spending!''

John Taylor's version here...

Nod to WH

SMBC Christmas Theater

Is there a Santa? SMBC Theater has the answer. Well, an answer. A twisted answer.

Merry, merry Christmas!

UPDATE: I'm pretty sure But there is no child. James wears the body of a small child, so you feel like there is a bigger cast. Seems happier that way...

Merry, merry Christmas!

UPDATE: I'm pretty sure But there is no child. James wears the body of a small child, so you feel like there is a bigger cast. Seems happier that way...

Monday, December 24, 2012

SMBC Christmas Theater

Have you ever wondered what happened to Scrooge AFTER his conversion to goodness? Is goodness and charity all it's cracked up to be? And what would happen if Tiny Tim could show the ghosts of Christmas past, present, and future the consequences of what they had done? Well, NOW YOU KNOW.

Robustly and exuberantly NSFW. But full of the Christmas spirit. Sort of.

And, there's a bonus "Hand to Mouth," a cooking show. Sort of.

Robustly and exuberantly NSFW. But full of the Christmas spirit. Sort of.

And, there's a bonus "Hand to Mouth," a cooking show. Sort of.

Monday's Child is Full of Links!

1. The new museum in Amsterdam is a bathtub museum. Not a museum about bathtubs, but literally a museum shaped like one. (Nod to Dutch Boy)

2. The idea of MISspelling something is modern. The difficulty of spelling in English is ancient.

3. An objection to the ability of markets to get the rate of time discount "correct." My question: as compared to what? Compared to legislators with a two year time horizon (okay, six in the Senate, right after an election)? Why don't people make fun of the "efficient governments" hypothesis? The libertarian argument is not that markets are perfect, it's that politicians are even more short-sighted.

4. Not easy going from very poor to post-college success. Families are pretty good at forgiving failure. It's what they expect. If your mom, dad, and uncles all failed to break out, then it's okay that you didn't. What's hard to handle is success. Poor kids have no one to tell them how to handle that. And for the family back home, it feels like rejection. In the south, "Gettin' above yer raisin'." Or in more urban vernacular, "She's a Tomasina. She ain't keepin' it real."

5. The 12 Days of Development. (Nod to Marc B.)

6. If everything is abundant, nothing is scarce. KPC pal Zach Weiner on economics. As always with Zach, you start to laugh, and then say...."Wait..." Zach once sent me an original of one of his drawings, which I had admired, and I took the drawings to get them framed. The guy at the frame shop was in awe: "You got these from Zach Weiner? I used to...." (he paused for emphasis) "...read Saturday Morning Breakfast Cereal EVERY DAY." I asked why he stopped. "Oh, after I stopped I wasn't quite as suicidal." That's the sort of story where either you ask more questions, or you don't. I didn't.

2. The idea of MISspelling something is modern. The difficulty of spelling in English is ancient.

3. An objection to the ability of markets to get the rate of time discount "correct." My question: as compared to what? Compared to legislators with a two year time horizon (okay, six in the Senate, right after an election)? Why don't people make fun of the "efficient governments" hypothesis? The libertarian argument is not that markets are perfect, it's that politicians are even more short-sighted.

4. Not easy going from very poor to post-college success. Families are pretty good at forgiving failure. It's what they expect. If your mom, dad, and uncles all failed to break out, then it's okay that you didn't. What's hard to handle is success. Poor kids have no one to tell them how to handle that. And for the family back home, it feels like rejection. In the south, "Gettin' above yer raisin'." Or in more urban vernacular, "She's a Tomasina. She ain't keepin' it real."

5. The 12 Days of Development. (Nod to Marc B.)

6. If everything is abundant, nothing is scarce. KPC pal Zach Weiner on economics. As always with Zach, you start to laugh, and then say...."Wait..." Zach once sent me an original of one of his drawings, which I had admired, and I took the drawings to get them framed. The guy at the frame shop was in awe: "You got these from Zach Weiner? I used to...." (he paused for emphasis) "...read Saturday Morning Breakfast Cereal EVERY DAY." I asked why he stopped. "Oh, after I stopped I wasn't quite as suicidal." That's the sort of story where either you ask more questions, or you don't. I didn't.

2nd Amendment Fail

Wow. My impression is that Robert Parry was once a legitimate journalist. But he's totally phoning this in

How about some Grand Game, 2nd Amendment history Fisking edition?

Here ya go.

How about some Grand Game, 2nd Amendment history Fisking edition?

Here ya go.

The Real Rationale for the 2nd Amendment, That Right-Wingers Are Totally Ignorant About

Mr. Parry may have a point about Washington, at that particular point, but there was a rebellion. The overall truth is more complicated. Here is a nice collection of quotes that express the views of many of the other Founders on the 2nd Amendment.

With a nod to Michael H., for picking out this gem.

Sunday, December 23, 2012

Hobo Down

Hobo is gone. He was our sweet old dog friend. Just an amazing friendly personality, quiet and calm. A nobility. He had trouble breathing, and we took him to the emergency (vet) hospital. They took x-rays. Poor guy had almost no lung function, cancer everywhere.

The YYM and I held him as his last breath, unlabored because they had him on oxygen, went out. That's the third time I have seen a dog put down. Something goes out of the world, something is gone. Call it spirit, spark, electrical impulses, whatever you want. But it's remarkable.

Two pix of Hobo when he was young. Loved to nap in the sun, even then. Note the stick in his mouth. He was playing dead, waiting for me to try to grab the stick so he could run away.

And Hobo loved the YYM. YYM called Hobo his "little brother." Sweet. Here they are in July, 2001, just two months after we got him. (Hobo, not the YYM). Hobo is having a little nip of ear. Yum!

Hobo had been scheduled to be euthanized, at the pound, in early 2001. He was "aggressive," and nobody would take him. But the lady who worked there said he was a great dog, and thought he was just scared because he was always being moved around. So we took him home, because he had the most interesting and expressive eyes.

At the end Hobo just mostly napped in the warm sun. And of course I was happy to join him. His muzzle and the fur around his eyes had gone totally white, by the end. We had him eleven years, and he was part of our family. Goodbye, old friend.

UPDATE: From comments....Oatmeal, and the paradox that is dog.

The YYM and I held him as his last breath, unlabored because they had him on oxygen, went out. That's the third time I have seen a dog put down. Something goes out of the world, something is gone. Call it spirit, spark, electrical impulses, whatever you want. But it's remarkable.

Two pix of Hobo when he was young. Loved to nap in the sun, even then. Note the stick in his mouth. He was playing dead, waiting for me to try to grab the stick so he could run away.

And Hobo loved the YYM. YYM called Hobo his "little brother." Sweet. Here they are in July, 2001, just two months after we got him. (Hobo, not the YYM). Hobo is having a little nip of ear. Yum!

Hobo had been scheduled to be euthanized, at the pound, in early 2001. He was "aggressive," and nobody would take him. But the lady who worked there said he was a great dog, and thought he was just scared because he was always being moved around. So we took him home, because he had the most interesting and expressive eyes.

At the end Hobo just mostly napped in the warm sun. And of course I was happy to join him. His muzzle and the fur around his eyes had gone totally white, by the end. We had him eleven years, and he was part of our family. Goodbye, old friend.

UPDATE: From comments....Oatmeal, and the paradox that is dog.

Insults

This is a bit dry, but interesting. And it has the line, "Munger just doesn't sound like a good word." Nice.

Plus, I'm a thumb-biter. Wow.

Plus, I'm a thumb-biter. Wow.

I had no idea...

There is this epic poem, quite famous. I didn't know it, though. The battle of Maldon, it is.

And there are people who make movies with Lego figures. Didn't know that, either.

So, here is a Lego movie about the epic poem, with old English subtitles. In comments, people are whining that it should be read in old English, with modern subtitles. And you think economists are weird.

And there are people who make movies with Lego figures. Didn't know that, either.

So, here is a Lego movie about the epic poem, with old English subtitles. In comments, people are whining that it should be read in old English, with modern subtitles. And you think economists are weird.

Saturday, December 22, 2012

I'm too sexy (for my job)

Yikes! Good thing neither Mungo or I live in Iowa. Not sure how the Hawkeye Supreme Court decided this one. Did they apply Marbury vs. Madison? Kramer vs. Kramer? Douchey vs. Bagg?

Did the court read out a verdict or did they just show this video?

One more while we are in the wayback machine:

Did the court read out a verdict or did they just show this video?

One more while we are in the wayback machine:

An Interesting "Year in Review"

Cornell's Dr. David Collum writes a yearly "Year in Review." Lots of interesting stuff there.

I enjoyed his link to this oldie-but-goodie, from Father Guido Sarducci:

I enjoyed his link to this oldie-but-goodie, from Father Guido Sarducci:

Friday, December 21, 2012

Okay, so THIS is the Parody

Okay, so the original was just awful, not a parody. Here is the parody.

Will Farrell as DB and John C. Reilly as BC. That explains the resurgence of the original.

And, to be fair and to placate commenters, the original duet of the SONG was very, very nice. Beautiful voices. But the video is just creepy, even more so now that Jeff H informs me that it was not a joke.

Will Farrell as DB and John C. Reilly as BC. That explains the resurgence of the original.

And, to be fair and to placate commenters, the original duet of the SONG was very, very nice. Beautiful voices. But the video is just creepy, even more so now that Jeff H informs me that it was not a joke.

Robin Hood? Nope, Just Another Bunch of Thugs with a Good Press Agent

It has never been clear to me why the right chooses to fight about whether "we" (whatever that means) should "help" (whatever that means) the "poor." (whatever THAT means).

The two questions should be:

1. Is it possible to help the poor? That is, can even the best-designed program, implemented correctly, actually do anything to help the poor and to reduce poverty?

2. Is there any reason to believe there is a substantial probability of actual politicians, the kind of people actually in the world, not in the fevered imaginations of statist zealots, will actually do anything like what is required if #1 is to be satisfied?

I think the answer to #1 is largely "no." Attempts to give away money create rent-seeking contests that dissipate most, or all, or perhaps even more than all, the amount of resources "we" (what does that mean?) try to give away.

But the answer to #2 is clearly and robustly "no." This is the public choice critique, in its simplest and starkest form.

Which leads me to "Munger's Law," which I use in class all the time. It goes like this:

Start with this statement: "The [state / government] should do XXXX, because people can't choose for themselves and I trust that the [state / government] will do a better job."

Maybe the reason that people can't choose for themselves is that they don't have the resources, so we'll use Food Stamp programs to give them more. Or maybe people can't choose for themselves because they are too stupid and weak, so we'll have laws against drugs and prostitution. Or maybe people can't choose because there's a collective action problem, like zoning or pollution problems.

All I ask is that the person making this statement make the following change: "Politicians I actually know, who live in the world, should do XXXX, because people can't choose for themselves and I trust that those politicians will do a better job."

It's almost impossible for that to be true, in most cases. People want "the state" to be in charge, but then when it's George W. Bush they say, "Oh, I didn't mean HIM." People want "the state" to control policy, but when politicians support Amendment One (banning gay marriage in NC) we hear, "Not that! That's not what we wanted!"

How about taking from the rich and giving to the poor? Should the state be Robbing Hood? Can the state be expected to do that? Well, you get reelected by appealing to....the very poor, right? No, you get eleected by appealing to the very MIDDLE.

I give you (courtesy of WH) ....Milton Friedman and "Director's Law."

Think that's wrong? Our Prez threatened to veto "Plan B" NOT because it did too little for the poor, but because it imposed ANY cost on the middle class. You give things to the middle class, if you want to get elected. You don't give to the poor. That's nonsense. What politicians do is pester the bejeezus out of the poor, and shovel cash to the middle class. That's electoral politics; it couldn't be any other way.

The two questions should be:

1. Is it possible to help the poor? That is, can even the best-designed program, implemented correctly, actually do anything to help the poor and to reduce poverty?

2. Is there any reason to believe there is a substantial probability of actual politicians, the kind of people actually in the world, not in the fevered imaginations of statist zealots, will actually do anything like what is required if #1 is to be satisfied?

I think the answer to #1 is largely "no." Attempts to give away money create rent-seeking contests that dissipate most, or all, or perhaps even more than all, the amount of resources "we" (what does that mean?) try to give away.

But the answer to #2 is clearly and robustly "no." This is the public choice critique, in its simplest and starkest form.

Which leads me to "Munger's Law," which I use in class all the time. It goes like this:

Start with this statement: "The [state / government] should do XXXX, because people can't choose for themselves and I trust that the [state / government] will do a better job."

Maybe the reason that people can't choose for themselves is that they don't have the resources, so we'll use Food Stamp programs to give them more. Or maybe people can't choose for themselves because they are too stupid and weak, so we'll have laws against drugs and prostitution. Or maybe people can't choose because there's a collective action problem, like zoning or pollution problems.

All I ask is that the person making this statement make the following change: "Politicians I actually know, who live in the world, should do XXXX, because people can't choose for themselves and I trust that those politicians will do a better job."

It's almost impossible for that to be true, in most cases. People want "the state" to be in charge, but then when it's George W. Bush they say, "Oh, I didn't mean HIM." People want "the state" to control policy, but when politicians support Amendment One (banning gay marriage in NC) we hear, "Not that! That's not what we wanted!"

How about taking from the rich and giving to the poor? Should the state be Robbing Hood? Can the state be expected to do that? Well, you get reelected by appealing to....the very poor, right? No, you get eleected by appealing to the very MIDDLE.

I give you (courtesy of WH) ....Milton Friedman and "Director's Law."

Think that's wrong? Our Prez threatened to veto "Plan B" NOT because it did too little for the poor, but because it imposed ANY cost on the middle class. You give things to the middle class, if you want to get elected. You don't give to the poor. That's nonsense. What politicians do is pester the bejeezus out of the poor, and shovel cash to the middle class. That's electoral politics; it couldn't be any other way.

Fiscal Cliff

The meeting between the President and the Speaker was taped! And here is the video...

I'm afraid that the ending is a perfect description of the argument about the use of legislative rules to constrain politicians on spending, or the Fed on monetary policy. The endless series of police come to arrest the previous one. Brilliant.

Nod to WH

I'm afraid that the ending is a perfect description of the argument about the use of legislative rules to constrain politicians on spending, or the Fed on monetary policy. The endless series of police come to arrest the previous one. Brilliant.

Nod to WH

Something New, Under the Sun

This makes perfect sense. But it never occurred to me that it would be true. Very interesting. People feel bad about "wasting" resources (killing trees) when they use paper. Of course, that's like feeling bad about eating corn, or beets, or squash, or (fill in other plants here), since trees are just plants and we can grow more. So the whole "don't kill trees" thing is pretty dumb.

Nonetheless, to continue. SINCE people (rightly or wrongly) feel bad about wasting trees, they self-control their actions, and conserve.

But....if the opportunity to recycle presents itself--given that the market to recycle used paper towels is so efficient--not--people drop the self-regulation and use lots more paper! It's as if they say to themselves, "Since I'm recycling it, I'm not really wasting it, and I can use all I want!" (MORE AFTER THE BREAK!!)

Nonetheless, to continue. SINCE people (rightly or wrongly) feel bad about wasting trees, they self-control their actions, and conserve.

But....if the opportunity to recycle presents itself--given that the market to recycle used paper towels is so efficient--not--people drop the self-regulation and use lots more paper! It's as if they say to themselves, "Since I'm recycling it, I'm not really wasting it, and I can use all I want!" (MORE AFTER THE BREAK!!)

The edited volume blues

"Dr. Karen" has a few thoughts on the topic of "Should I do an edited collection". I reproduce it verbatim here as I have nothing to add to its towering awesomeness and truthfulness.

No.

Let me say it again: No.

Let’s put it a different way:

You: But, it’s just the papers from a conference panel. Is it ok then?

Me: No.

You: But, I’m co-editing it, so I don’t have to do all the work. Is it ok then?

Me: No. And, please, co-editing? Are you kidding me?

You: But all I have to do is collect and edit the papers and write an Intro. Is it ok then?

Me: No. And you’re doing all this and don’t even have a chapter in it? Are you kidding me?

You: But I’ll have a book for tenure. Me: No, you won’t. Edited collections don’t count.

You: But it’ll get me a job.

Me: You want to know what’ll get you a job? A REFEREED JOURNAL ARTICLE IN THE TOP JOURNAL IN YOUR FIELD. Write that! Write two of them! Hell, you can write a whole effing monograph in the time you are going to waste fighting with your contributors, waiting for the external reviewers, arguing with your lame press, agonizing over the copy-editing, and trying to market the book because your lame press doesn’t spend a dime in advertising.

You: Really?

Me: Yes.

You: An editor from a really great press I never heard of actually got in touch with me! And asked me to do it! Is it ok then?

Me: No, and never, ever, ever accept an offer of publication from someone from a press you’ve never heard of. Or even a press you have heard of, if they come chasing after you. It’s the prom, sweetheart. Don’t go with the first person who asks you (unless they’re the dream date you’ve been waiting for). Do the work, and get yourself into position to get the date you really want.

You: But I am already committed.

Me: Get out of the commitment.

You: But it’s my friends.

Me: Have drinks with your friends. Go to Vegas with your friends. Do not waste your precious writing and research time gathering up and, god forbid, editing, your friends’ questionable essays and volunteering unpaid, uncredited time to get your friends a publication. And by the way, their chapter in your edited collection is barely going to do them any good either.

You: But I’m going to go ahead and do this edited collection.

Me: It’s your funeral.

No.

Let me say it again: No.

Let’s put it a different way:

You: But, it’s just the papers from a conference panel. Is it ok then?

Me: No.

You: But, I’m co-editing it, so I don’t have to do all the work. Is it ok then?

Me: No. And, please, co-editing? Are you kidding me?

You: But all I have to do is collect and edit the papers and write an Intro. Is it ok then?

Me: No. And you’re doing all this and don’t even have a chapter in it? Are you kidding me?

You: But I’ll have a book for tenure. Me: No, you won’t. Edited collections don’t count.

You: But it’ll get me a job.

Me: You want to know what’ll get you a job? A REFEREED JOURNAL ARTICLE IN THE TOP JOURNAL IN YOUR FIELD. Write that! Write two of them! Hell, you can write a whole effing monograph in the time you are going to waste fighting with your contributors, waiting for the external reviewers, arguing with your lame press, agonizing over the copy-editing, and trying to market the book because your lame press doesn’t spend a dime in advertising.

You: Really?

Me: Yes.

You: An editor from a really great press I never heard of actually got in touch with me! And asked me to do it! Is it ok then?

Me: No, and never, ever, ever accept an offer of publication from someone from a press you’ve never heard of. Or even a press you have heard of, if they come chasing after you. It’s the prom, sweetheart. Don’t go with the first person who asks you (unless they’re the dream date you’ve been waiting for). Do the work, and get yourself into position to get the date you really want.

You: But I am already committed.

Me: Get out of the commitment.

You: But it’s my friends.

Me: Have drinks with your friends. Go to Vegas with your friends. Do not waste your precious writing and research time gathering up and, god forbid, editing, your friends’ questionable essays and volunteering unpaid, uncredited time to get your friends a publication. And by the way, their chapter in your edited collection is barely going to do them any good either.

You: But I’m going to go ahead and do this edited collection.

Me: It’s your funeral.

Thursday, December 20, 2012

Betty!

For more then 30 years, I have heard Angus call himself "Betty." (Nope, no more details. Just trust me here.)

So, in honor of Angus, I made a video about externalities in which Betty figures prominently. I am not a very attractive man, but it turns out I am a genuinely repulsive woman.

A credit: I had never recognized the centrality of manners, and "moral" social norms in controlling externalities. But my main man Russ Roberts pointed it out in editing this piece, and then doing this podcast, years ago. So, a big post Festival of Lights shout out to RR: when I say "Manners," I always think of YOU, big man!

UPDATE: Sam Wilson, yes, of COURSE the model for Art is the Dub-MOE. I even tried to get that vacant Pooh-bear expression down. As for Carl....well, a guy needs SOME secrets.

UPDATE II: I don't mean to claim there is anything intellectually novel here, folks. My good friend John Nye had a very nice piece, years ago, that makes the "knowledge problem" point way better in print. And this recent post by Steven Landsburg did a nice job summarizing the issues, and the problems, of an arbitrary "starting point." Oh, and Mario Rizzo, too. I could go on, but the point is that I am sumarizing what a lot of people already know, but rarely gets taught when the subject of externalities comes up in basic micro courses.

So, in honor of Angus, I made a video about externalities in which Betty figures prominently. I am not a very attractive man, but it turns out I am a genuinely repulsive woman.

A credit: I had never recognized the centrality of manners, and "moral" social norms in controlling externalities. But my main man Russ Roberts pointed it out in editing this piece, and then doing this podcast, years ago. So, a big post Festival of Lights shout out to RR: when I say "Manners," I always think of YOU, big man!

UPDATE: Sam Wilson, yes, of COURSE the model for Art is the Dub-MOE. I even tried to get that vacant Pooh-bear expression down. As for Carl....well, a guy needs SOME secrets.

UPDATE II: I don't mean to claim there is anything intellectually novel here, folks. My good friend John Nye had a very nice piece, years ago, that makes the "knowledge problem" point way better in print. And this recent post by Steven Landsburg did a nice job summarizing the issues, and the problems, of an arbitrary "starting point." Oh, and Mario Rizzo, too. I could go on, but the point is that I am sumarizing what a lot of people already know, but rarely gets taught when the subject of externalities comes up in basic micro courses.

Would Tarzan Believe in God?

Would Tarzan believe in God? Conditions for the emergence of religious belief

Konika Banerjee & Paul Bloom, Trends in Cognitive Sciences, forthcoming

Abstract: Would someone raised without exposure to religious views nonetheless come to believe in the existence of God, an afterlife, and the intentional creation of humans and other animals? Many scholars would answer yes, proposing that universal cognitive biases generate religious ideas anew within each individual mind. Drawing on evidence from developmental psychology, we argue here that the answer is no: children lack spontaneous theistic views and the emergence of religion is crucially dependent on culture.

So, would God believe in Tarzan? I think not. That whole story of being raised in the jungle is pretty implausible. I think God prefers nonfiction--biographies and sweeping histories--to those kinds of fantasy novels.

Nod to Kevin Lewis, who believes in Tarzan, I believe

Konika Banerjee & Paul Bloom, Trends in Cognitive Sciences, forthcoming

Abstract: Would someone raised without exposure to religious views nonetheless come to believe in the existence of God, an afterlife, and the intentional creation of humans and other animals? Many scholars would answer yes, proposing that universal cognitive biases generate religious ideas anew within each individual mind. Drawing on evidence from developmental psychology, we argue here that the answer is no: children lack spontaneous theistic views and the emergence of religion is crucially dependent on culture.

So, would God believe in Tarzan? I think not. That whole story of being raised in the jungle is pretty implausible. I think God prefers nonfiction--biographies and sweeping histories--to those kinds of fantasy novels.

Nod to Kevin Lewis, who believes in Tarzan, I believe

A Very Merry European Christmas

The marriage is one the rocks. Germany has lost its love for Greece, and England is waiting in the wings...

It's a sequel to this "Very European Break-up"

It's a sequel to this "Very European Break-up"

Little Drummer Boy from Bing and David

We posted this two years ago. But since it's Christmas time, and just for the readers of KPC, here is four minutes of your life you will never get back, and will be mad that you watched. But it's like a train wreck, you. just. can't. look. away.

Bing Crosby and David Bowie sing, "The Little Drummer Boy." It's a parody, but of what?

Bing Crosby and David Bowie sing, "The Little Drummer Boy." It's a parody, but of what?

Wednesday, December 19, 2012

It's a Miracle Edition of Grand Game

Michael Rennie was ill

The day the supply curve stood still

But he told us

Where we stand.

And Paul Krugman was there in silver underwear

Bob Reich was the invisible man

It's a miracle. Minimum wage creates middle class people!

Nod to Chateau, and his "Denton" t-shirt.

The day the supply curve stood still

But he told us

Where we stand.

And Paul Krugman was there in silver underwear

Bob Reich was the invisible man

It's a miracle. Minimum wage creates middle class people!

Nod to Chateau, and his "Denton" t-shirt.

Last Minute Christmas Gifts! Christmas 2012 Last Minute Edition

Need some last minute Christmas gifts, for that discerning sort of person who hangs out with KPC readers? Not just ANY gift, but a cool gift that you can actually get shipped in time for the day, arriving (ojala!) on Monday?

Books on war and strategy

Beauty product samples of the month, each month, $10.

If you know something the person likes, buy an on-line subscription. They might never pay for the ad-free version of Pandora, for example, but it's cheap and they will actually use it! And your friend/SO can listen on phone, laptop, or any computer at home. It's quite handy.

Noodle Of The Month club! Or some other food subscription. But good Italian pasta in particular is a nice, easy to use, product that everybody likes! (Okay, not for Angus, but for people without allergies to gluten)

Membership in an art museum, theater company, etc. If you live near SOME kind of city, there must be a season subscription or membership you can buy. And though they may not have bought it for themselves, a good theater subscription will get them out of the house to go see some plays.

Buy an "experience," from a site like this, or perhaps like this, even more generally. Unusual, interesting, and you can still get 'er done in time for the day!

Books on war and strategy

Beauty product samples of the month, each month, $10.

If you know something the person likes, buy an on-line subscription. They might never pay for the ad-free version of Pandora, for example, but it's cheap and they will actually use it! And your friend/SO can listen on phone, laptop, or any computer at home. It's quite handy.

Noodle Of The Month club! Or some other food subscription. But good Italian pasta in particular is a nice, easy to use, product that everybody likes! (Okay, not for Angus, but for people without allergies to gluten)

Membership in an art museum, theater company, etc. If you live near SOME kind of city, there must be a season subscription or membership you can buy. And though they may not have bought it for themselves, a good theater subscription will get them out of the house to go see some plays.

Buy an "experience," from a site like this, or perhaps like this, even more generally. Unusual, interesting, and you can still get 'er done in time for the day!

Angus' 2012 Music Picks

OK people, forget about Frank Ocean and Grizzly Bear. I got the 2012 musical goods for you right here.

My favorite 10 albums, in no particular order.

Moon Duo: Circles

the Duo have reigned themselves in a bit this time around, but their fuzzed out glory never ever gets old.

Peaking Lights: Lucifer

Perhaps not quite as good as "936", but lo-fi pysch dub has not yet gotten remotely old for me.

Tame Impala: Lonerism

A little on the polished side for me, but just so good. Sure, it's "retro" get over it and get into it!

Purity Ring: Shrines

I didn't think I'd like this album. Thought I was too old and grumpy. This is amazing music. Part Sundays, part 4 Tet, mesmerizing.

Waxahatchee: American Weekend

Wow! So happy that music like this is being made in 2012. A little Mountain Goats a little Liz Phair and a lot of awesome.

Tindersticks: The Something Rain

A return to form from one of my all-time favorite bands. I read a review that called Tindersticks the spiritual father of The National. I think that might be right.

King Tuff: King Tuff

This guy is just the bizzle. Makes up for Harlem not putting out a record this year.

Royal Headache: Royal Headache

So so so good. Can Australia be the cradle of rock nowadays?

Beak: >>

Very Krauty and very cool. Give it some time.

Deep Time: Deep Time

Man, Austin TX just keeps spawning great music.

My favorite 10 albums, in no particular order.

Moon Duo: Circles

the Duo have reigned themselves in a bit this time around, but their fuzzed out glory never ever gets old.

Peaking Lights: Lucifer

Perhaps not quite as good as "936", but lo-fi pysch dub has not yet gotten remotely old for me.

Tame Impala: Lonerism

A little on the polished side for me, but just so good. Sure, it's "retro" get over it and get into it!

Purity Ring: Shrines

I didn't think I'd like this album. Thought I was too old and grumpy. This is amazing music. Part Sundays, part 4 Tet, mesmerizing.

Waxahatchee: American Weekend

Wow! So happy that music like this is being made in 2012. A little Mountain Goats a little Liz Phair and a lot of awesome.

Tindersticks: The Something Rain

A return to form from one of my all-time favorite bands. I read a review that called Tindersticks the spiritual father of The National. I think that might be right.

King Tuff: King Tuff

This guy is just the bizzle. Makes up for Harlem not putting out a record this year.

Royal Headache: Royal Headache

So so so good. Can Australia be the cradle of rock nowadays?

Beak: >>

Very Krauty and very cool. Give it some time.

Deep Time: Deep Time

Man, Austin TX just keeps spawning great music.

Links

The links of Wednesday....

1. Going through a dry spell? End it with a bang!

2. Is health insurance like auto insurance? Should it be?

3. I looked, but there was no sign-up sheet for volunteers. New treatment...

4. Giving the lie to the idea that medicine is a "public service."

5. Evaluation in medical services: 1. Did you spend your budget? 2. If not, why the FiretrUCK not? Go back and spend it, ALL of it, you idiot. 3. If yes, add 10% and submit new budget. Notice that service and customer satisfaction never appear in this "evalution" process at all.

6. All of political psychology reduced to one variable? Okay, MOST, not all. But it is striking.

7. Sometimes, the world just tells its own jokes. Here's the setup: David Brooks scheduled to teach course on "humility" at Yale. Presumably, DB will have P-Kroog in for some guest lectures on the more advanced "Topics in Humility" sections. It's at Yale, too. You can't make this stuff up. DB recognizes that course title will provoke "smart ass jibes," but he's just too humble to care.

8. Thank GOODNESS there's a Republican House, to hold the line on spending. If only there were a third party, one that was SERIOUS about the deficit...

9. Robert Bork has died.

10. The Smutty Professor. Porco? Really? Not sure what to think about this.

11. The defense theory ("The Owl Did It!") may fly, after all. Michael Peterson, about whom Angus has mused before.

12. Local knowledge is sustainable: Hayek would have been a local focal guy.

Nod to Angry Alex, Anonyman, and Kevin Lewis

1. Going through a dry spell? End it with a bang!

2. Is health insurance like auto insurance? Should it be?

3. I looked, but there was no sign-up sheet for volunteers. New treatment...

4. Giving the lie to the idea that medicine is a "public service."

5. Evaluation in medical services: 1. Did you spend your budget? 2. If not, why the FiretrUCK not? Go back and spend it, ALL of it, you idiot. 3. If yes, add 10% and submit new budget. Notice that service and customer satisfaction never appear in this "evalution" process at all.

6. All of political psychology reduced to one variable? Okay, MOST, not all. But it is striking.

7. Sometimes, the world just tells its own jokes. Here's the setup: David Brooks scheduled to teach course on "humility" at Yale. Presumably, DB will have P-Kroog in for some guest lectures on the more advanced "Topics in Humility" sections. It's at Yale, too. You can't make this stuff up. DB recognizes that course title will provoke "smart ass jibes," but he's just too humble to care.

8. Thank GOODNESS there's a Republican House, to hold the line on spending. If only there were a third party, one that was SERIOUS about the deficit...

9. Robert Bork has died.

10. The Smutty Professor. Porco? Really? Not sure what to think about this.

11. The defense theory ("The Owl Did It!") may fly, after all. Michael Peterson, about whom Angus has mused before.

12. Local knowledge is sustainable: Hayek would have been a local focal guy.

Nod to Angry Alex, Anonyman, and Kevin Lewis

Tuesday, December 18, 2012

More Russian Drivers

David Skarbek sends this video, on the "Crazy Russian Drivers" meme. I started not to put it up, because it's pretty horrible. But the cows appear to get up in pretty good shape. The driver.... hard to say.

Too Much Faith, Not Too Little